After 15 years helping businesses navigate complex tax issues, I’ve noticed a pattern. Companies hire business operations consultants to fix supply chains, improve workflows, and cut costs. But they overlook the single area where smart strategy creates the most dramatic financial impact – tax operations. I’ve seen companies hemorrhage six figures annually through preventable tax inefficiencies, while their general operations consultants focused on optimizing procurement processes that might save a few thousand dollars.

Here’s what most business owners don’t realize. Your operations aren’t separate from your tax strategy – they’re inseparable. The entity structure you choose, how you compensate owners and employees, where you locate operations, how you handle R&D expenses, when you recognize revenue, how you depreciate assets – these operational decisions create either massive tax advantages or equally massive tax liabilities. A general operations consultant won’t catch these issues because they’re not tax attorneys. And by the time you discover the problem, you’ve often missed critical deadlines or locked yourself into inefficient structures that cost hundreds of thousands to fix.

What Operations Consulting Actually Means

At its core, business operations consulting focuses on improving how a company’s internal systems, processes, and workflows function day to day. Operations consultants analyze areas like supply chain management, procurement, financial planning, technology integration, and process efficiency. Their goal is identifying weaknesses that limit growth or profitability, then implementing strategies to address them.

This sounds valuable, and it can be. But here’s the problem. Most consultants approach improvement through an operational lens – faster processes, better technology, more efficient workflows. They miss the strategic tax implications of virtually every operational decision they recommend. I’ve reviewed countless consulting proposals that would have saved a company $50,000 in operational costs while creating $200,000 in additional tax liability.

The Intersection of Business Operations Consultants and Tax Strategy

Let me give you a real example from my practice. A manufacturing client hired an operations consultant who recommended restructuring their supply chain to reduce inventory costs. The consultant’s proposal would save approximately $75,000 annually in carrying costs and warehouse expenses. Sounds great, right?

The problem? The restructuring required liquidating $2 million in existing inventory at a loss, triggering immediate taxable income of $500,000 under Section 481(a) adjustment rules. It also eliminated their ability to use the LIFO inventory method going forward, which had been saving them $150,000 annually in deferred taxes. The operational savings were real, but the tax cost over five years exceeded $1 million – making the entire strategy financially disastrous.

This is why business operations consulting needs tax expertise integrated from the start. Every operational decision triggers tax consequences. Entity structure affects how income is taxed and what deductions are available. Compensation strategies determine payroll tax obligations and owner distributions. Capital investments create depreciation schedules that dramatically impact cash flow. Multi-state operations trigger nexus issues and varying tax obligations.

How Tax Operations Consulting Differs from Business Operations Consulting

Tax-focused operations consulting starts with a different question. Instead of “How can we make this process more efficient?” we ask “How can we structure this operation to minimize tax liability while achieving our business objectives?” This seemingly small shift in perspective creates dramatically different outcomes.

We analyze your organization’s structure – LLC, S-Corp, C-Corp, partnership – and determine if it’s optimal for your current situation and growth plans. Many companies choose entity structures based on generic advice from formation services or recommendations that made sense five years ago but are now costing them substantial money. I regularly find businesses structured as C-Corps paying double taxation when S-Corp treatment would eliminate it, or sole proprietors paying 15.3% self-employment tax on income that could be shielded through proper entity selection.

We examine compensation strategies to balance reasonable salaries, distributions, and deferred compensation in ways that minimize both income and employment taxes. We review capital expenditure timing and accelerated depreciation elections under Section 179 (up to $2.56 million for 2026 with a $4.09 million phase-out threshold), 100% bonus depreciation fully restored under the One Big Beautiful Bill Act for assets placed in service in 2026, and cost segregation studies that can dramatically accelerate deductions. We identify R&D tax credit opportunities – particularly valuable now that the One Big Beautiful Bill Act restored immediate expensing for domestic R&D expenses under new Section 174A starting in 2025, ending the five-year amortization requirement that had been in place since 2022.

We analyze multi-state operations to understand nexus creation, apportionment formulas, and state tax minimization strategies. Economic nexus rules continue to tighten in 2026, with Illinois eliminating its 200-transaction threshold effective January 1, 2026, joining 15 other states that now use only dollar thresholds ranging from $100,000 to $500,000. We review international operations for foreign tax credit optimization, transfer pricing compliance, and GILTI minimization. These aren’t peripheral tax issues to address after you’ve made operational decisions – they should drive how you structure operations from the beginning.

The Hidden Tax Costs in Common Operational Changes

Businesses make operational changes constantly. Hiring employees in new states. Opening additional locations. Changing inventory methods. Acquiring competitors. Selling corporate units. Modifying compensation structures. Investing in new equipment. Each triggers tax consequences that often go unrecognized until tax filing, when it’s too late to fix them.

Hiring employees in new states creates nexus, potentially subjecting your entire organizations to that state’s income tax, sales tax obligations, and employment tax requirements. I’ve seen companies hire a single remote employee in California, creating nexus that cost them $80,000 in back taxes they didn’t know they owed. Opening new locations triggers similar issues, plus property tax obligations and potential loss of tax incentives in your original location.

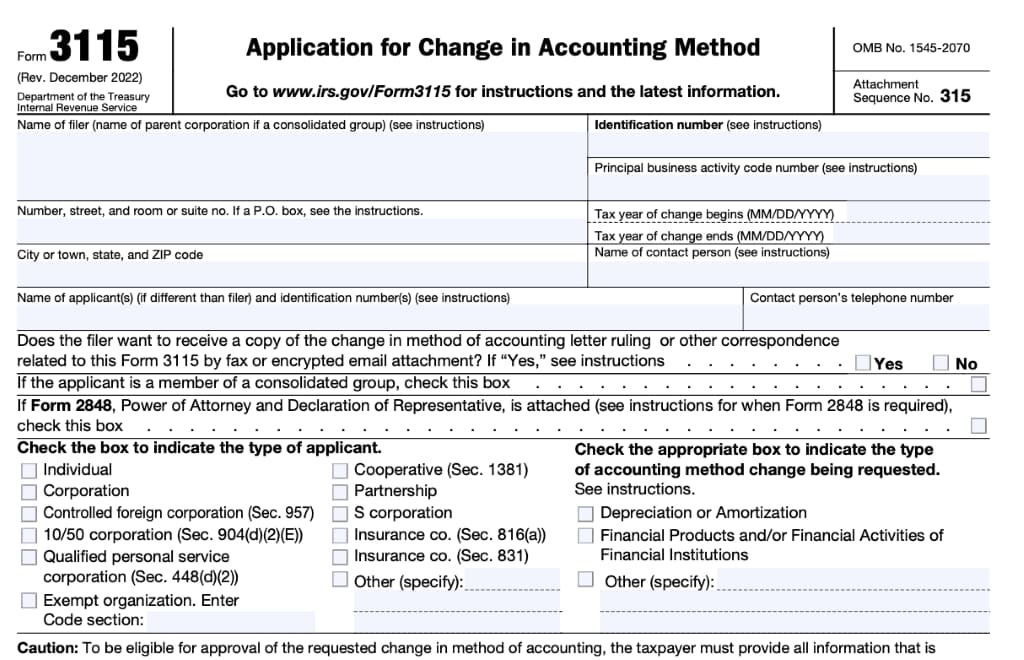

Changing accounting methods – revenue recognition, inventory valuation, depreciation methods – requires IRS Form 3115 filed within specific timeframes. Miss the deadline, and you’re locked into the inefficient method for years. Section 481(a) adjustments required when changing methods can create significant taxable income that must be spread over four years for positive adjustments, while negative adjustments generally provide immediate benefit. Acquiring competitors requires careful tax due diligence and structure planning. Buy assets versus stock? Section 338(h)(10) election? Allocation of purchase price? These decisions create tax differences of hundreds of thousands of dollars.

Compensation changes affect both employee and employer taxes. Converting employees to contractors saves payroll taxes but creates misclassification risk. Adding benefits triggers deductibility and fringe benefit taxation issues. Implementing equity compensation requires careful planning around AMT, Section 83(b) elections, and qualified small business stock rules.

When You Actually Need Operations Consulting

You need operations consulting – specifically tax-integrated operations consulting – when you’re experiencing any of these situations:

- Your tax liability keeps increasing faster than your revenue, suggesting structural inefficiencies.

- You’re expanding to new states or international markets.

- You’re considering changing entity structure or ownership.

- You’re planning significant capital investments.

- You’re acquiring or selling corporate assets.

- You’re restructuring compensation or adding equity incentives.

You also need it when you sense you’re paying more tax than comparable companies in your industry, when you’re dealing with multi-state or international operations without clear tax strategy, or when past tax returns show missed opportunities or inefficient structures.

The earlier you engage tax-focused consulting, the more options you have. Once you’ve made operational decisions and filed tax returns, many optimization strategies become unavailable or much more expensive to implement.

The Real Benefits of Tax Operations Consulting

The primary benefit is straightforward – you pay less tax legally. Not through aggressive schemes or questionable positions, but through proper structure and planning. I’ve helped clients reduce tax liability by 20% to 40% annually through legitimate structural improvements. On a business generating $1 million in taxable income, that’s $200,000 to $400,000 in annual savings.

Beyond direct tax savings, proper tax operations consulting improves cash flow. When you’re not overpaying quarterly estimates or facing surprise tax bills, you have more capital for growth. It reduces audit risk because your structure and positions are properly documented and supported. It eliminates costly corrections – restructuring after the fact typically costs three to ten times more than structuring correctly initially.

It also provides leadership clarity. When you understand the tax implications of operational decisions, you make better strategic choices. Should you lease or buy that equipment? In 2026, with 100% bonus depreciation restored, purchasing may provide immediate tax benefits that leasing cannot. Should you hire employees or contractors? Depends on your specific tax situation and worker classification risks. Should you expand to that new state? Depends on nexus implications and that state’s tax structure.

What Tax Operations Consulting Actually Involves

Tax operations consulting starts with comprehensive analysis. We review your current entity structure, review three to five years of tax returns, analyze your operational footprint across states, examine your compensation structures, identify your capital assets and depreciation schedules, and understand your growth plans and strategic objectives.

From that analysis, we identify optimization opportunities. Entity restructuring possibilities. Missed deductions or credits from prior years – for example, many businesses that capitalized domestic R&D expenses in 2022-2024 can now elect to deduct remaining unamortized amounts immediately in 2025 or spread over 2025-2026 under the One Big Beautiful Bill Act. Accounting method improvements requiring Form 3115 filing. Multi-state tax planning strategies given evolving economic nexus standards. Compensation restructuring opportunities. Capital expenditure timing and elections to maximize Section 179 and bonus depreciation benefits. Then we prioritize recommendations based on impact and implementation complexity.

Implementation is where many consultants fail. They identify issues but don’t help you fix them. We work with you to implement recommended changes – preparing and filing entity restructuring documents, filing Form 3115 for accounting method changes including transitions to immediate R&D expensing, preparing state tax registrations and nexus analyses as economic nexus rules evolve, implementing new compensation structures with proper documentation, making depreciation elections on proper deadlines to capture 100% bonus depreciation, and preparing amended returns when beneficial.

Then we provide ongoing advisory. Tax operations consulting isn’t a one-time project. Tax law changes constantly – witness the dramatic shift from five-year R&D amortization back to immediate expensing in 2025, or the continued evolution of state economic nexus standards. Your organization evolves, and new opportunities and risks emerge. We provide quarterly or monthly operations consulting calls to review planned operational changes before implementation, monitor tax law changes affecting your business, prepare for estimated tax payments to avoid surprises, and adjust strategy as your company grows.

Common Mistakes General Operations Consultants Make

I’ve reviewed hundreds of operational recommendations from general consulting firms, and certain tax mistakes appear repeatedly. They recommend entity changes without understanding tax implications. Converting from C-Corp to S-Corp triggers built-in gains tax on appreciated assets. Merging entities can create unexpected taxable income. Adding partners or members affects profit allocations and tax obligations.

They suggest compensation changes without considering payroll tax impacts. Increasing bonuses versus salary affects FICA calculations. Converting employees to 1099 contractors creates misclassification exposure. Implementing equity compensation without proper planning triggers AMT and Section 409A issues.

They propose process changes that create state nexus. Storing inventory in new states. Hiring remote employees. Using drop-ship arrangements. Each potentially creates filing obligations and tax liability in those states. With economic nexus thresholds now as low as $100,000 in annual sales (and Illinois removing its transaction threshold in 2026), nexus exposure is easier to trigger than ever.

They recommend technology investments without optimizing depreciation elections. Section 179 (now $2.56 million for 2026), 100% bonus depreciation (restored in 2026 after phasing down to 40% in 2025), and standard depreciation produce dramatically different cash flow outcomes. They recommend R&D investments without understanding that domestic research expenses can now be fully deducted in 2026 rather than amortized, creating immediate cash flow benefits.

They restructure supply chains without considering inventory accounting method impacts. LIFO liquidations, Section 481(a) adjustments, and other accounting method changes create immediate tax consequences that can dwarf operational savings.

How to Choose a Tax Operations Consultant

Not all tax consultants understand business operations consulting, and not all operations consultants understand tax. You need someone with deep expertise in both areas – specifically, someone who practices tax law and has experience with company operations optimization.

Look for actual tax attorneys, not accountants or bookkeepers. While good CPAs are valuable for compliance, tax strategy requires legal expertise in IRC provisions, regulations, case law, and IRS procedures. Look for someone who regularly represents clients before the IRS – this demonstrates they understand not just what’s technically correct, but what positions the IRS will challenge and how to defend them.

Ask about specific experience with your company size and industry. Tax strategy for a $500,000 revenue sole proprietorship differs dramatically from strategy for a $50 million multi-state corporation. Industry matters too – manufacturing has different considerations than professional services. Verify they provide implementation support, not just analysis. Recommendations without implementation leave you in the dangerous position of knowing what should change but not knowing how to change it correctly.

Ask about their knowledge of recent tax law changes. Any consultant who doesn’t immediately mention the restoration of R&D expensing, 100% bonus depreciation for 2026, or evolving state economic nexus standards isn’t staying current.

The Cost-Benefit Analysis of Tax Operations Consultants

Tax operations consulting typically costs $5,000 to $50,000 depending on business size and complexity. Small companies with straightforward operations might pay $5,000 to $15,000 for comprehensive analysis and implementation. Mid-size organizations with multi-state operations or complex structures might pay $20,000 to $35,000. Large businesses or those with international operations might pay $40,000 to $50,000 or more.

Compare that to the typical savings. On an organization with $1 million in taxable income, identifying 20% in tax savings through proper structure and planning produces $200,000 in annual benefit. That’s a return on investment of 400% to 4,000% in the first year alone. The savings recur annually, so over five years, that initial $10,000 to $50,000 investment produces $1 million in cumulative tax savings.

Consider the opportunities now available under 2026 tax law. If your company capitalized $500,000 in domestic R&D expenses during 2022-2024, you can now elect to deduct the remaining unamortized amount immediately, potentially creating $100,000+ in current-year tax savings. If you’re planning equipment purchases in 2026, 100% bonus depreciation allows immediate deduction of the full cost rather than spreading over five to seven years. These opportunities require proper planning and timely elections – miss the deadlines, and you lose substantial benefits.

I’ve never had a client regret investing in proper tax operations consulting. I’ve had countless clients regret waiting – paying hundreds of thousands in unnecessary taxes before finally addressing structural inefficiencies, then paying tens of thousands more to correct problems that could have been avoided entirely.

Don’t Confuse Business Operations Consulting With Tax Strategy

General business operations consultants serve a valuable purpose. They understand supply chains, process improvement, technology integration, and workflow optimization. But they’re not equipped to integrate tax strategy into operational recommendations, and the tax implications of their suggestions often outweigh the operational benefits.

If you need help with operations, make sure tax strategy is integrated from the beginning. This means engaging someone who understands both areas – not hiring separate consultants and hoping they’ll coordinate effectively. Operations decisions without tax consideration create expensive problems. Tax strategy without operational understanding doesn’t work either. You need both, integrated from the start.

At Silver Tax Group, I provide tax-integrated operations consulting for companies ranging from startups to multi-million dollar enterprises. I understand how operational decisions trigger tax consequences, and I structure recommendations to achieve your corporate objectives while minimizing tax liability. I don’t just identify problems – I implement solutions, preparing the legal documents, filing the IRS forms including Form 3115 for accounting method changes and elections for R&D expensing and depreciation benefits, and providing the ongoing advisory you need as your company evolves.

If your business is growing, changing, or simply paying too much tax, let’s talk about how proper tax operations strategy can improve your financial results. Contact Silver Tax Group today for a confidential consultation. We’ll review your current structure, identify optimization opportunities including immediate benefits available under 2026 tax law, and show you exactly how much money proper tax planning could save your organization. Call us at (855) 900-1040 or visit our website to schedule your consultation. With over $128 million saved for our clients from IRS matters, we have the proven track record and specialized expertise your company needs to compete effectively in today’s tax environment.

Frequently Asked Questions: Business Operations Consulting

Business operations consulting is a professional service where outside experts analyze and improve your internal processes, workflows, and operational systems to increase efficiency, reduce costs, and enhance performance.

Operations consultants identify areas of inefficiency, recommend process improvements, support supply chain optimization, and help implement solutions that improve workflow and financial performance.

Consultants analyze cost drivers—such as labor, materials, and overhead—and recommend streamlined processes and tools to eliminate waste and reduce unnecessary expenses.

Typical benefits include improved performance, more efficient workflows, better leadership decision-making, technological integration, and often measurable cost savings.

You should consider an operations consultant when internal processes are causing delays, costs are rising without clear causes, or performance metrics consistently fall short of goals.

Companies should be prepared to communicate goals, embrace recommended changes, and set realistic expectations for improvements—consulting is a collaborative and iterative process.