IRS Tax Audit Representation & Defense

Get expert help from real tax attorneys who have decades of experience with the IRS and specialize in tax audits.

We Win For Our Clients

Attorneys Winning Against the IRS Daily

Available 24 hrs / 7 Days A Week

Get expert help from real tax attorneys who have decades of experience with the IRS and specialize in tax audits.

If you’ve received an audit notice, then it’s important to work with a tax attorney who will help you get through this challenging time. You need someone who can represent your best interests and make sure that everything is handled properly.

Our tax attorneys know what they’re doing and will be able to ensure that your case gets resolved in a timely manner. They’ll let you know if there’s something wrong with how taxes were filed in previous years so no one has to pay back money they don’t owe! They’ll also keep track of all deadlines so nothing falls through the cracks. This way, you won’t have to worry about anything because they’ll take care of it for you!

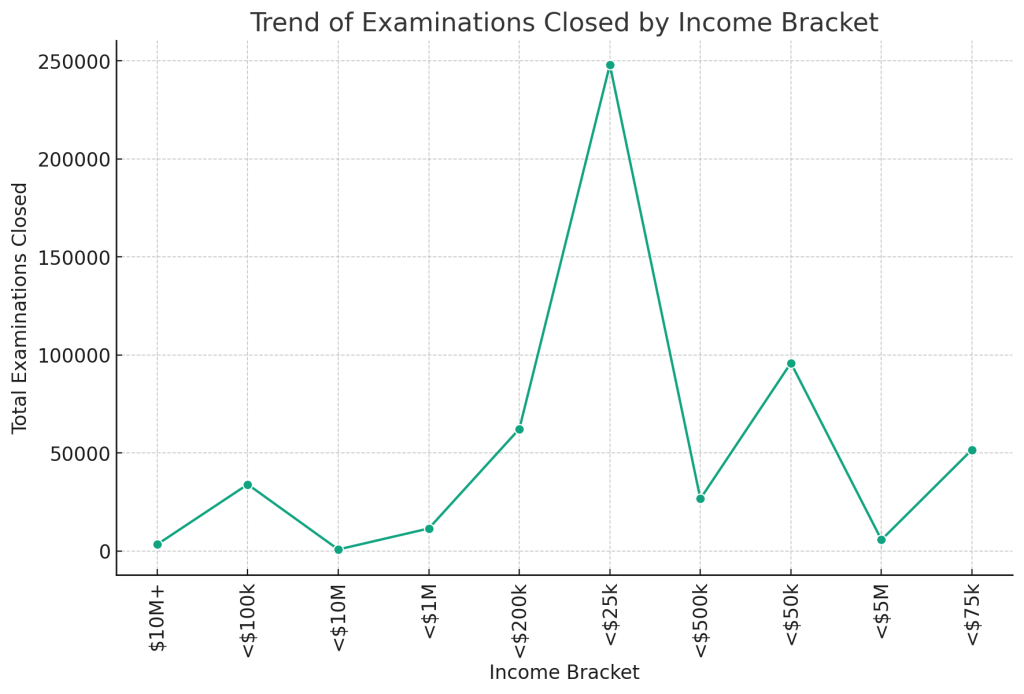

Every year, the IRS audits approximately one million tax returns (1).

If you’re part of this small group of people dealing with an IRS audit, you might be feeling a little anxious or overwhelmed. Work with a tax professional to help with your tax audit defense. An IRS audit notice can put fear and doubt in the mind of even the most confident person. It is the financial and legal equivalent of being followed by the police block after block.

Eventually, you start asking yourself questions:

Make no mistake — if you are being audited by the IRS, you do face the possibility of significant tax penalties and even criminal charges if things don’t go your way.

As part of your audit, the IRS will jam you with paperwork requests, demanding an incredible amount of documentation within a tight 30-day deadline.

For the average person — even an accountant for that matter — IRS audits are fraught with pitfalls. If you’re unsure of how to proceed, hiring a tax attorney can help to give you peace of mind and help you know what steps to take to get this issue resolved.

WHEN YOU HIRE US, WE CAN HELP YOU:

An Internal Revenue Service (IRS) audit often occurs when the IRS needs to confirm some details on a tax return form and determine its accuracy. Approximately one in 75 individuals get audited by the IRS.

This implies that about 80 percent of all taxpayers will get audited at some point during their working lifetime. However, it is not always random. Those who get selected are often people who have a much higher likelihood of making an error or fraudulent claims on the tax return.

The IRS is one of the most powerful organizations and known to “win” a majority of their audits. This is because most individuals are unsure of all tax laws or what they need to deliver to the auditor, resulting in many tax filers owing the IRS money.

Due to these factors, IRS audits can be stressful and frightening. Rather than getting frustrated and anxious about an upcoming IRS audit, it is best to acquire an IRS audit defense. A strong audit defense includes the services of a professional tax attorney, who can assist in looking for all the possibilities that will ensure a positive financial outcome at the conclusion of the audit.

The IRS audit process can get complicated. Especially if it’s an office or field audit.

You don’t want it to last any longer than it has to. That’s why it’s so important to have a tax professional helping to guide you through the process.

We can help. You can rely on our tax attorneys to obtain the best possible outcome regardless of your individual circumstances. We’re here for you. Our mission is to make sure that you get taken care of in the best way you can be. Contact us today for a free case evaluation about your IRS tax audit.

Notification: The initiation of an IRS audit commences with a formal notification. The IRS dispatches a notification letter to the taxpayer that delineates which tax return years are under scrutiny and which specific documents are needed.

Preparation: Upon receiving the notification, the taxpayer must meticulously prepare by gathering all requisite documentation that substantiates the entries on the tax return. It is paramount to review the tax return in question and reconcile it with supporting evidence.

Review: The actual audit process can be conducted via mail (correspondence audit), in an IRS office (office audit), or at the taxpayer’s place of business or home (field audit). During this stage, the IRS examiner will rigorously review the taxpayer’s documentation and may request additional information.

Response: Subsequent to the review, the taxpayer will have the opportunity to respond to the IRS examiner’s questions or concerns. This response can be critical in clarifying any misunderstandings or providing further context to the financial records.

Results: After a comprehensive review and response phase, the IRS will issue an audit report. This report details any discrepancies and proposes adjustments. The taxpayer can either agree with the findings and make necessary payments, or they can dispute the results.

Appeal: Should the taxpayer contest the audit findings, they can request a conference with an IRS manager or file an appeal if an agreement cannot be reached. This stage involves negotiation and, potentially, litigation to resolve the discrepancies.

Completion: The audit concludes when the IRS issues a final determination. If the taxpayer has agreed with the adjustments, or after an appeal has been resolved, they must comply with the outcome, which could involve additional taxes, penalties, or interest.

Adherence to these stages, combined with meticulous record-keeping and the engagement of tax professionals, is paramount for navigating an IRS audit with precision and integrity.

The IRS will never call you directly to let you know you’re being audited. Instead, you’ll find out through the mail. These are known as correspondence audits. This type of audit happens when the IRS has additional questions or requires more documentation to back up your return. Most times, all you need to do is submit the additional requested paperwork. Mail audits typically come within seven months of your filing and may take between three to six months to complete.

In cases where the IRS requires more information, they may require you to attend an in-person audit at a local IRS office. You just need to bring along the documentation they ask for. And it’s your right to bring along your accountant or an attorney to represent you. Office audits typically start within a year of your filing. As with mail audits, they tend to wrap up within three to six months. There are only delays if the auditor finds additional issues or you fail to provide them with complete information.

It’s more serious when the IRS requests to see you at your home or place of business. At that point, they want to conduct a more in-depth investigation. These only happen when the IRS spots major red flags or there are too many questions for them to ask in any other capacity. Field audits typically begin within a year after you file your return. They take about a year to complete because the IRS does an extensive review of your records and finances. They also often involve multiple tax years.

Thankfully, the IRS only has three years to charge you additional taxes on an audited return. The statute of limitations (2) expires three years from the date you filed it or the due date of the return, whichever is later.

While the IRS has three years to audit your return, most of the time the audit only takes a year. There’s even a training guide the IRS must adhere to stating they have 26 months after the due date of the return or the date it was filed, whichever is later.

However, if tax fraud is involved, there is NO statute of limitations. For large amounts of unreported income, the statute is six years. Most of the time the IRS only goes into an audit with the assumption that three years is the limit.

There are several IRS audit triggers that every person should be aware of. Obviously, not filing fraudulent returns is a big step towards never being audited.

Each year the IRS selects tax returns for an audit. This is only done to verify the information is accurate and does not necessarily mean there’s an issue. However, there are factors the IRS uses to select tax returns for an audit that can affect the outcome and length of your audit. If your auditor is making a lot of adjustments, it takes longer as they’ll most likely want to look at other tax years as well.

The IRS has two computers systems they use to analyze your return for potential errors. They also use it to calculate numeric scores. They use the Discriminant Function System (DIF) score as an indicator of potential changes. The Unreported Income DIF (UIDIF) score acts as an indicator of unreported income. Those returns with high scores are selected for a tax audit.

This is when the IRS matches the income you claim against the payer reports, such as a W9. If they don’t match, there’s a red flag and you’re likely to be audited.

The IRS selects tax returns to identify promoters and participants of abusive tax avoidance transactions.

If your business partner or an investor is audited and it doesn’t turn out well, there’s a good chance you’ll end up being audited as well.

Large corporations have more complex tax returns where it’s easy to make mistakes or purposely hide abusive tactics. Therefore, they’re more likely to be audited.

Those who own small businesses should assume their audit will also take longer. That’s because it’s harder for the IRS to track their income since it’s not reported on information statements. And if you’re a cash business, your audit could take longer.

From the moment you receive correspondence from the IRS, the audit defense team will be with you every step of the way until your situation is resolved. They will ensure to adequately represent you and guarantee that the IRS authority does not take complete control of the audit process.

Even if the audit was triggered by a minor error or excessive deductions, a tax attorney can view the case from multiple angles and find loopholes to legally protect your interests. IRS audit defense will eliminate the worry over an IRS audit of your business or personal taxes.

If the IRS finds problems, you’ll end up with penalties, which makes the process take even longer. If the IRS finds out you committed fraud, it can take years while they pursue criminal prosecution against you.

It’s your right to disagree with your audit. If you do, you’ll have to take it to IRS appeals and possibly court. That could take six months to a year to finalize.

Tax lawyers will draft all responses to IRS notices, deal with all the paperwork, attend every meeting and even help you present your case legally to the auditor. They can handle any challenging situations and fully comprehend the audit process as well as all tax-related jargon to deal with the auditor more effectively and ensure smooth communication between both parties. Good communication also helps the tax audit process to become quick and painless.

If you want to save your business and yourself from IRS penalties, interest fees and possible criminal charges such as jail time, you need a tax audit defense. The IRS has many resources readily available to pursue the tax audit. They can look deep into your financial history, dating back to many years before the current audit.

Once you have a reliable and experienced IRS defense, you may result in paying the lowest possible taxes and charges allowed by the taxation law or have your audits dismissed after the tax audit defense argues your appeal.

Representation by a tax attorney provides significant advantages of the attorney-client privilege. We never testify against our clients. This means that statements you make to your tax lawyer cannot be disclosed to the IRS or anyone else. A good IRS defense team will advise you on these privilege issues and even conduct privilege reviews.

No matter where you are in the process, we can help you make the best of your situation.

SILVER TAX GROUP LOCATIONS

32813 Middlebelt Rd Suite B

Farmington Hills, MI 48334

855-900-1040

Michigan Law Office

4005 Guadalupe St

Suite C

Austin, TX 78751

Austin, TX Law Office

Contact Us For A Free Consultation

Services

Resources

There is no Tax Specialist Board more comprehensive or difficult than the CPA Board Exam. The Lawyer is a licensed CPA.

© 2024 Silver Tax Group. All Rights Reserved. Sitemap

Need Tax Help? See If You Qualify For an IRS Hardship Program

IRS trouble can be frustrating and intimidating. Schedule a consultation to find out if you qualify for an IRS hardship program – it only takes a few minutes!

Don’t worry, our consultations are 100% Confidential & 100% Free