I’ve represented gamblers – both casual players and professionals – in disputes with the IRS for over 15 years. The most common mistake I see? People don’t realize that gambling winnings are fully taxable income, while losses are only deductible under specific conditions.

With new rules taking effect in 2026 that limit gambling loss deductions to 90% of your losses, understanding how to properly report your gambling activity has never been more critical.

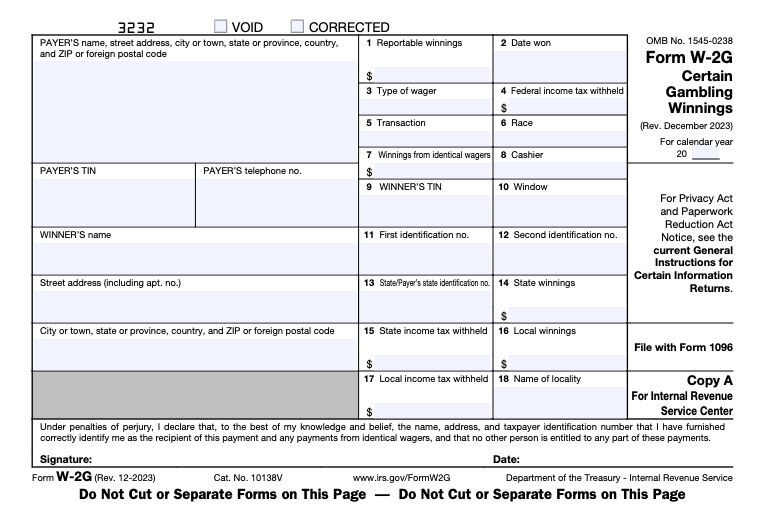

Here’s what keeps me up at night on behalf of my gambling clients. The IRS receives copies of every W-2G form issued by casinos and other gaming establishments. When you win $1,200 on a slot machine or $5,000 on a poker tournament, that casino reports it to the IRS. If you don’t report that income on your tax return, the IRS will catch it – usually within 12 to 18 months – and you’ll face not just the tax owed, but penalties and interest that can double your bill.

The 2026 Game Changer: Only 90% of Losses Are Deductible

If you gamble regularly, you need to understand a major change coming January 1, 2026. The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, fundamentally changed how betting losses work for tax purposes. Starting with your 2026 tax return (filed in early 2027), you can only deduct 90% of your gambling losses, even if those losses don’t exceed your winnings.

Let me show you what this means with real numbers. Say you have $100,000 in gambling winnings and $100,000 in wagering losses during 2026. You broke even – you didn’t make any money from gambling. Under the old rules (still in effect for 2025), you could deduct the full $100,000 in losses, resulting in zero taxable betting income. Under the new 2026 rules, you can only deduct $90,000 (90% of your $100,000 in losses). This means you’ll owe tax on $10,000 of “phantom income” – money you never actually made.

This gets even worse for high-volume gamblers. If you win $500,000 and lose $500,000 in 2026, you’ll owe tax on $50,000 despite breaking even. If you’re in the 37% tax bracket, that’s an $18,500 tax bill on money you never profited from. This new rule has created significant controversy in the gambling community, with bipartisan efforts underway to repeal it, but as of now, it takes effect January 1, 2026.

How Gambling Income and Losses Actually Work

Every dollar you win gambling is taxable income – whether it’s $50 from a lottery ticket, $5,000 from a poker tournament, or $100,000 from a slot jackpot. The IRS doesn’t care if you immediately lost that money in the next hand or the next spin. Winnings are income, period. You must report all wagering winnings on your tax return, even if you didn’t receive a W-2G form.

Gambling losses can offset your winnings, but only if you itemize deductions on Schedule A. If you take the standard deduction ($16,100 for single filers in 2026, $32,200 for married filing jointly), you get zero benefit from your losses. This is crucial – many casual gamblers take the standard deduction because it’s simpler, but then they lose the ability to deduct any betting losses while still owing tax on all their winnings.

You also can’t net your wins and losses and report only the difference. If you won $50,000 and lost $45,000, you can’t just report $5,000 in income. You must report the full $50,000 as income, then separately deduct the $45,000 in losses (or in 2026, 90% of that, which is $40,500). The IRS requires separate reporting of winnings and losses.

Professional vs. Casual Gamblers: Critical Tax Differences

The IRS draws a major distinction between professional gamblers and casual (recreational) gamblers, and this classification dramatically affects your taxes. If you’re a professional gambler – meaning gambling is your primary source of income and you approach it as a business – you report your activities on Schedule C as self-employment income. This allows you to deduct ordinary and necessary business expenses like travel to tournaments, entry fees, training materials, and professional development.

However, professional gamblers face self-employment tax (15.3%) on their net wagering income, which casual gamblers don’t pay. Professional status also subjects you to much more scrutiny from the IRS. You need to maintain detailed business records, separate business and personal finances, and demonstrate that you’re engaged in gambling with the intent to make a profit, not just for recreation.

For casual gamblers – which describes most people who gamble – your winnings are reported as “Other Income” on Form 1040, and your losses are reported on Schedule A as an itemized deduction. You cannot deduct any expenses related to betting (travel, meals, lodging at casinos), only your actual wagering losses. The new 90% limitation applies to both professional and casual gamblers starting in 2026.

The Record-Keeping Requirements Are Extensive

The IRS requires you to maintain contemporaneous records of all gambling activity. “Contemporaneous” means you need to record information at or near the time you gamble, not try to reconstruct it months later when you’re preparing your tax return. I’ve seen too many audits where gamblers claimed large losses but couldn’t produce adequate documentation, resulting in disallowed deductions and substantial tax bills.

At minimum, you need to keep a betting diary or log showing the date of each gambling session, the type of wagering (slots, poker, sports betting, horse racing, etc.), the name and address of the establishment, the names of other people present, and the amounts you won or lost each session. This isn’t optional – it’s required by the IRS.

Beyond the diary, you need supporting documentation. This includes wagering tickets, canceled checks, credit card records, bank withdrawal records, W-2G forms, statements from gambling establishments, and for table games, credit records showing table numbers and issuance of credit. For slot machines, record machine numbers and the time you played. For keno, keep validated tickets and casino credit records. For bingo, save receipts showing the cost of cards purchased. For sports betting, keep payment slips and unredeemed tickets.

What Counts as Gambling Income?

The IRS defines gambling income broadly. It includes winnings from casinos, poker rooms, racetracks, lotteries, raffles, bingo, keno, sports betting (including fantasy sports with entry fees), and online betting where legal. It includes cash winnings, the fair market value of prizes won (cars, trips, electronics), and even comp points or rewards that can be converted to cash or used for goods and services.

If you win a non-cash prize, you owe tax on its fair market value. Win a $50,000 car at a casino? You owe tax on $50,000 of income. The casino will typically report this on a W-2G. You can’t avoid the tax by declining the prize – once you’ve won it, it’s taxable income whether you keep it or not.

How to Actually Deduct Your Gambling Losses

To deduct gambling losses, you must itemize deductions on Schedule A of Form 1040. Your wagering losses go on Line 16 of Schedule A under “Other Itemized Deductions.” For 2025 tax returns, you can deduct 100% of your losses up to the amount of your winnings. Starting with 2026 tax returns, you can deduct only 90% of your losses, up to 90% of your winnings (whichever is less).

Let’s walk through the 2026 calculation with an example. You have $80,000 in winnings and $75,000 in losses. First, calculate 90% of your losses: $75,000 x 90% = $67,500. Next, calculate 90% of your winnings: $80,000 x 90% = $72,000. Your deduction is limited to the lesser of these two amounts. In this case, you can deduct $67,500. You’ll owe tax on $12,500 ($80,000 in winnings minus $67,500 in deductible losses).

Here’s another scenario. You have $50,000 in winnings and $80,000 in losses. Calculate 90% of losses: $72,000. Calculate 90% of winnings: $45,000. Your deduction is limited to $45,000 (the lesser amount), so you’ll owe tax on $5,000 despite losing $30,000 more than you won.

This is why the new rule is so controversial – it creates tax liability even when you have net losses from gambling. There’s bipartisan legislation pending in Congress to repeal this 90% limitation, but unless that passes, it takes effect for 2026.

State Taxes Add Another Layer

Don’t forget about state taxes. Most states with income tax also tax gambling winnings, and some states that don’t have income tax (like Nevada) may still withhold taxes on large betting winnings for nonresidents.

State rules on deducting gambling losses vary widely. Some states allow the same deduction as federal (matching the federal itemized deduction), some limit it differently, and some don’t allow any deduction for wagering losses at all.

If you gamble in multiple states, you may owe taxes in each state where you had winning sessions, even if your net gambling for the year was a loss. This creates complex multi-state filing requirements. I’ve seen cases where someone wins $100,000 in Nevada, loses $120,000 in New Jersey, and ends up owing taxes in both states despite losing money overall.

W-2G Forms: What Triggers Them

Betting establishments must issue you a W-2G form and report your winnings to the IRS when you reach certain thresholds. For 2025, these thresholds are $1,200 or more from slots or bingo, $1,500 or more from keno, $5,000 or more from poker tournaments, $600 or more from horse racing (if the winnings are at least 300 times the wager), and other gambling winnings of $600 or more where the winnings are at least 300 times the amount wagered.

Significant news for slot players – starting January 1, 2026, the threshold for W-2G reporting on slot machine and bingo winnings increases from $1,200 to $2,000. The IRS confirmed this change in December 2025, ending months of uncertainty about whether the OBBBA provision actually modified W-2G reporting thresholds. This will reduce the number of W-2G forms issued and the interruptions to play for smaller jackpots. The new $2,000 threshold will then increase annually with inflation starting in 2027. However, this doesn’t change your obligation to report all wagering income – you must report even winnings below the W-2G threshold.

When you receive a W-2G, the gambling establishment may withhold 24% for federal taxes (28% if you don’t provide a Social Security number). This withholding is credited against your total tax liability when you file your return. If you’re a professional gambler or expect significant betting income, you may need to make quarterly estimated tax payments to avoid underpayment penalties.

Audit Risks for Gamblers

Gambling-related tax issues trigger audits at higher rates than most other itemized deductions. The IRS specifically targets taxpayers who report large wagering losses, particularly when those losses approach or equal reported winnings. They’re looking for people who claim losses to offset W-2G income but don’t have adequate documentation.

Red flags that increase audit risk include reporting gambling winnings but no losses (suggesting unreported losses), reporting losses that exactly equal winnings (looks suspicious), reporting losses significantly higher than typical for your level of play, claiming betting as a profession without proper business documentation, not reporting W-2G income that the IRS received copies of, and wide year-to-year swings in reported gambling activity.

If you’re audited, you must prove your claimed losses with contemporaneous records and supporting documentation. “I kept track in my head” or “I remember losing about that much” won’t work. The IRS will disallow inadequately documented losses, potentially resulting in taxes, penalties, and interest on thousands of dollars of income.

Strategies to Minimize Your Gambling Tax Burden

Given the new 90% limitation, minimizing your gambling tax burden requires strategy. First, keep meticulous records. With the 90% rule, every dollar of properly documented losses matters more than ever. Second, consider whether itemizing makes sense. If your total itemized deductions (betting losses, mortgage interest, charitable contributions, state and local taxes) don’t exceed the standard deduction, you won’t benefit from the gambling loss deduction at all.

Third, manage your wagering timing. If you’re having a losing year, you might avoid additional gambling that could generate taxable winnings. If you’re having a winning year, additional play that generates losses (up to 90% of those losses in 2026) can help offset the winnings. Fourth, for large betting activities, consider structuring play to maximize deductible losses within the 90% limitation.

Fifth, if you’re gambling professionally or semi-professionally, work with a tax professional to determine if Schedule C treatment makes sense despite the self-employment tax cost. Finally, stay informed about pending legislation. Multiple bills have been introduced to repeal the 90% limitation, and if one passes, it could retroactively change the 2026 rules.

Don’t Let Gambling Taxes Become a Losing Bet

The intersection of gambling and taxes has always been complex, but the 2026 changes make it even more challenging. Between the new 90% limitation, the extensive record-keeping requirements, and the IRS’s focus on audits, getting your gambling taxes wrong can be expensive.

At Silver Tax Group, I’ve helped hundreds of gamblers – from casual players to poker professionals – navigate their tax obligations and defend them during IRS audits. I understand the unique challenges gamblers face, from documenting losses to handling multi-state tax issues to determining whether professional gambler status makes sense for your situation.

If you’ve received a W-2G and aren’t sure how to report it, if you have significant betting losses you need to document, if you’re facing an audit related to gambling income, or if you need help understanding how the new 2026 rules affect your specific situation, we’re here to help.

Don’t wait until the IRS contacts you about unreported gambling income or inadequately documented losses. Contact Silver Tax Group today for a confidential consultation.

We’ll review your wagering activity, help you develop proper record-keeping systems, prepare accurate returns that maximize your deductions within the law, and defend you if the IRS questions your reporting. Call us at (855) 904-0180 or visit our website to schedule your consultation. With over $128 million saved for our clients from IRS matters, we have the specialized expertise to protect your interests when gambling and taxes collide.

Frequently Asked Questions: How to Deduct Gambling Losses From Your Taxes

Yes. All gambling winnings—cash and the fair market value of prizes—must be reported as income on your federal tax return.

You can deduct gambling losses only if you itemize deductions and only up to the total amount of your reported gambling winnings.

Beginning in 2026, new rules will limit gambling loss deductions to 90% of gambling winnings, meaning you may have taxable income even on net losing years.

Maintain detailed records, including dates of activity, amounts won/lost, receipts/tickets, and any Form W-2G statements to support loss deductions.

Professional gamblers may report gambling earnings and losses on Schedule C and deduct ordinary and necessary business expenses, though loss deduction caps still apply.

Not always. A W-2G is issued when certain thresholds are met (e.g., $600+ on some wagering), but all winnings must still be reported.