For U.S. taxpayers with foreign financial accounts, compliance with FBAR filing requirements is crucial. The Financial Crimes Enforcement Network (FinCEN) mandates that individuals and businesses with foreign financial assets exceeding a certain threshold file FinCEN Form 114, commonly known as FBAR (Foreign Bank Account Report).

Failure to report foreign accounts can result in severe IRS offshore penalties, including substantial fines and possible criminal charges. With increased IRS enforcement and evolving FinCEN FBAR rules, staying compliant in 2025 is more critical than ever.

This guide explains everything you need to know about FinCEN Form 114, including who must file, reporting thresholds, common mistakes, and how to avoid penalties when reporting foreign bank accounts.

Today, you’ll learn:

FBAR Compliance Is Mandatory – U.S. taxpayers with foreign financial accounts exceeding $10,000 at any point during the year must file FinCEN Form 114 (FBAR) to avoid penalties.

Severe Penalties for Non-Compliance – Failure to file an FBAR can lead to civil penalties of up to $10,000 per violation for non-willful errors and 50% of account balances per year for willful violations, along with potential criminal charges.

FBAR Is Separate from IRS Tax Returns – Unlike typical IRS forms, FBAR is filed electronically with FinCEN through the BSA E-Filing System and has an automatic extension to October 15 if not filed by April 15.

Foreign Crypto Accounts May Require FBAR Filing – While final regulations are pending, FinCEN plans to require reporting of foreign cryptocurrency accounts, making it critical for crypto holders to stay updated on compliance rules.

FBAR and FATCA Are Different – While FBAR (FinCEN Form 114) and FATCA (IRS Form 8938) both require reporting of foreign assets, they have different thresholds, filing locations, and penalties. Taxpayers may need to file both forms depending on their foreign holdings.

What Is FinCEN Form 114 (FBAR)?

FinCEN Form 114, commonly referred to as FBAR, is a mandatory reporting form required by the Bank Secrecy Act (BSA). It is used to report foreign financial accounts held by U.S. taxpayers, ensuring transparency and preventing offshore tax evasion.

Unlike standard IRS tax forms, FinCEN Form 114 is filed electronically with FinCEN, not the IRS. However, the IRS enforces compliance and penalizes non-filers.

Who Must File FinCEN Form 114 (FBAR)?

- You are a U.S. person, including citizens, green card holders, residents, corporations, partnerships, LLCs, trusts, and estates

- You have a financial interest in or signature authority over one or more foreign accounts

- The total value of all foreign accounts exceeded $10,000 at any point during the calendar year

Who Is Considered a U.S. Person?

The term ‘U.S. person’ for FBAR purposes is more inclusive than one might initially think. U.S. persons include:- U.S. citizens and residents

- U.S. persons who reside outside of the U.S.

- Corporations, partnerships, or limited liability companies established in the U.S. or under U.S. laws

- Trusts or estates formed under U.S. law, provided they meet the relevant criteria

- You must have foreign-earned income from personal services performed in a foreign country.

- Your tax home must be in a foreign country during the tax year.

Therefore, whether you are a U.S. citizen working overseas, a resident alien, or a participant in a U.S.-based corporation, partnership, or trust with foreign financial interests, it’s imperative to comply with FBAR reporting requirements.

Common Types of Reportable Foreign Accounts

These accounts typically trigger the FBAR filing requirement:

- Foreign bank accounts (checking, savings)

- Brokerage or securities accounts overseas

- Mutual funds and foreign retirement plans

- Life insurance policies with a cash value

- Foreign-held digital wallets and crypto accounts

Even if you don’t personally own the account but can direct transactions or access funds, you may be required to report it.

Accounts That Are Typically Exempt

You are generally not required to report:

- Correspondent or Nostro accounts

- Accounts at U.S. military banking facilities overseas

- IRAs and qualified retirement plans you own or benefit from

- Accounts held by U.S. government or international organizations

- Foreign accounts jointly owned with a spouse, if your spouse files and you submit Form 114a

If you’re unsure whether your account is exempt, review FinCEN and IRS guidelines or consult a tax professional.

Understanding Signature Authority and Form 114a

You might need to file an FBAR even if you don’t personally own the money in a foreign account. Signature authority means you can sign for transactions or access the account, which triggers the reporting requirement. This applies to employees who handle their company’s foreign bank accounts, beneficiaries who can access their parent’s or relative’s foreign accounts, and anyone listed on a joint foreign account. If you have this kind of access, you must report the account if it meets the $10,000 threshold.

However, there’s a simpler option: your employer can file the FBAR on your behalf using Form 114a with your written consent. This works well for employees who handle company accounts but don’t personally own the funds.

One helpful note: if you only have signature authority without any ownership interest, you don’t need to keep copies of the account statements or records. The account owner handles that responsibility.

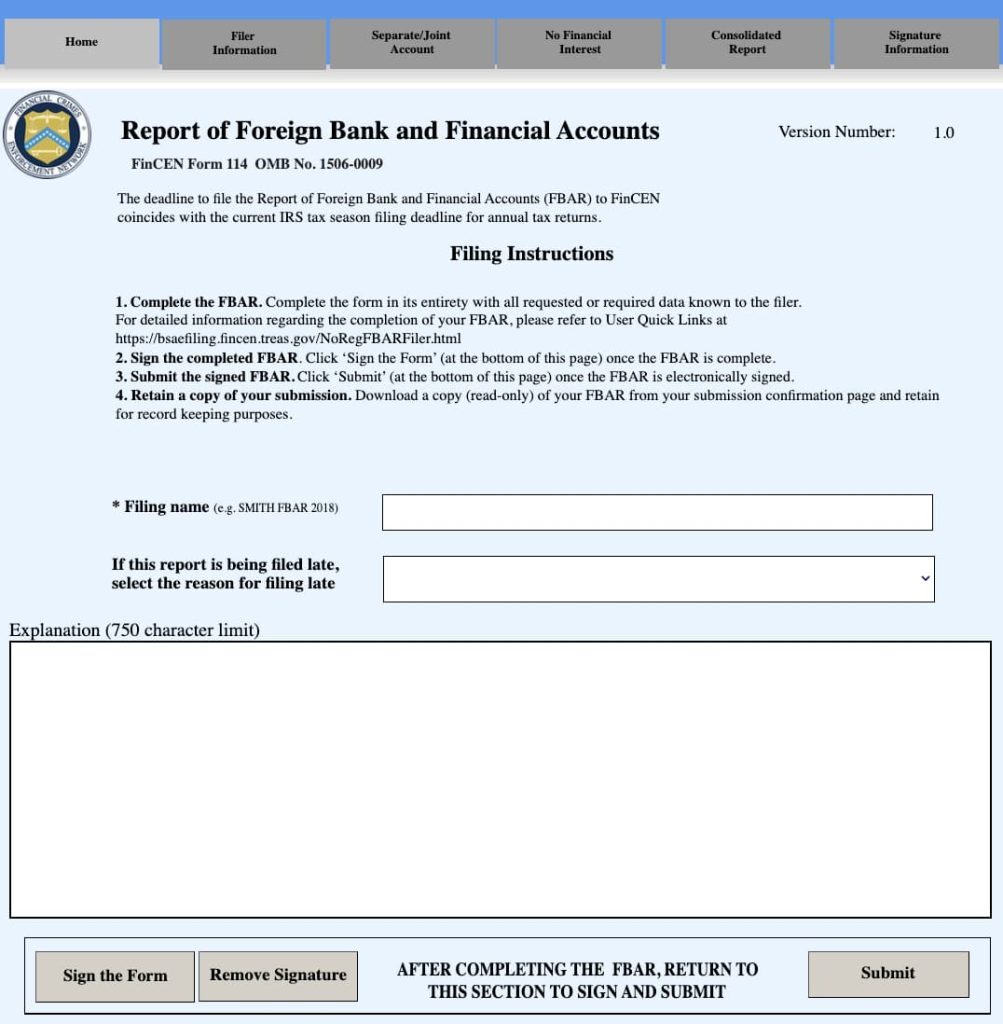

How to File FinCEN Form 114 (FBAR) in 2025

Step 1: Gather Your Account Information

Before you start, collect these details for each foreign account:

- Name and address of the foreign financial institution

- Account number

- Maximum account balance during the tax year (not just the year-end balance)

- Account type (bank, investment, pension, etc.)

Step 2: Register for the BSA E-Filing System

Registration requirements depend on who’s filing:

For Banks, Insurance Companies, and Financial Institutions: Your organization must enroll through FinCEN’s BSA E-Filing System and register all supervisory users.

For Tax Professionals (CPAs, Enrolled Agents, Law Firms): You’ll need to create an account with a User ID, password, and security questions to file on behalf of clients.

For Individuals: You can register yourself, or let Silver Tax Group handle the entire filing without you needing to set up an account. We’ll manage your User ID, security setup, and submission directly through the BSA system.

Step 3: Complete FinCEN Form 114

You’ll need to provide:

- Personal identification (Social Security number or EIN)

- Foreign financial institution details (name, address, account number)

- The highest balance your account reached at any point during the year—not just the December 31 balance

Important: Convert all foreign currency balances to U.S. dollars using the Treasury Department’s official exchange rate from December 31 of the reporting year.

Step 4: File Electronically

Submit your FBAR through FinCEN’s BSA E-Filing System. The form cannot be filed with your tax return or sent to the IRS.

Step 5: Keep Records for 5 Years

After filing, retain these documents for at least five years:

- Bank statements showing account balances

- Account opening documents

- Financial institution contact information

- Form 114a (if your employer filed on your behalf)

These records protect you during IRS audits and demonstrate compliance with FBAR requirements.

FBAR Filing Checklist

This checklist provides a step-by-step guide to help you properly file your FBAR. Follow each step carefully to ensure you meet all the necessary requirements and deadlines.| Step | Task | Complete |

|---|---|---|

| 1 | Gather all financial documents and account statements from your foreign accounts. | ☐ |

| 2 | Identify every foreign account where you have a financial interest or signature authority. | ☐ |

| 3 | Verify that the combined balance of these accounts exceeds $10,000 at any time during the year. | ☐ |

| 4 | Collect the dates and highest balance figures for each account. | ☐ |

| 5 | Convert foreign currency balances into U.S. dollars using the official exchange rate. | ☐ |

| 6 | Complete FinCEN Form 114 with all required account details. | ☐ |

| 7 | Review all information for accuracy and consistency before filing. | ☐ |

| 8 | File the FBAR electronically via the FinCEN BSA E-Filing System. | ☐ |

| 9 | Keep copies of the filed FBAR and all supporting documentation. | ☐ |

| 10 | Mark the filing deadline on your calendar and follow up on any required corrections. | ☐ |

Important Reminder: Always double-check your data for accuracy and keep detailed records of all your foreign accounts and transactions. Filing your FBAR on time is crucial to avoid hefty penalties, so make sure you understand each step of the process and reach out for professional advice if needed.

FBAR Filing Deadline for 2025

Regular Deadline: April 15, 2025

Automatic Extension: Until October 15, 2025 (no separate request needed)

If an FBAR is not filed by April 15, FinCEN grants an automatic extension to October 15. However, failure to file by the extended deadline may result in severe IRS offshore penalties.

Do Digital and Crypto Accounts Count?

Yes. Non-traditional accounts held abroad are still subject to FBAR if they meet the filing threshold.

Examples include:

- PayPal or Apple Pay accounts connected to foreign banks

- Crypto wallets or exchanges located outside the U.S.

If the maximum value of these accounts exceeds $10,000 at any time during the year, they must be reported.

To determine your filing obligation, ask yourself:

- Is the account held outside the U.S.?

- Do I have ownership or control over the funds?

- Did the value ever exceed $10,000?

If the answer is yes to all three, you’re likely required to file.

What Are the Penalties for Failing to File FinCEN Form 114?

Failure to comply with FBAR filing requirements can result in harsh civil and criminal penalties, depending on whether the violation is considered willful or non-willful.

1. Non-Willful FBAR Violations

If a taxpayer accidentally fails to file FBAR, the penalty can be:

- Up to $10,000 per violation (adjusted for inflation)

- Possible waiver if the taxpayer can prove reasonable cause

2. Willful FBAR Violations

If a taxpayer intentionally fails to disclose foreign accounts, penalties increase significantly:

- Greater of $100,000 or 50% of the account balance per violation

- Criminal penalties including fines up to $500,000 and up to 10 years in prison

3. IRS Offshore Voluntary Disclosure Program (OVDP)

If you missed past FBAR filings, you may be eligible to correct your mistakes through the IRS’s voluntary disclosure programs. Options include:

- Streamlined Filing Compliance Procedures – For taxpayers who failed to file due to non-willful errors.

- Offshore Voluntary Disclosure Program (OVDP) – For those with potential willful violations, allowing them to reduce penalties.

Ignoring FBAR requirements can lead to seizures, audits, and criminal investigations, so it is essential to stay compliant or resolve past non-filing issues quickly.

FBAR vs. Form 8938: Understanding the Difference

Many people think FBAR and Form 8938 are the same thing. They’re not. You might need to file both, and mixing them up can cost you.

Here’s the key difference: FBAR goes to FinCEN when your foreign accounts hit $10,000 total. Form 8938 goes to the IRS with your tax return when you reach $50,000 (or $75,000 at any point during the year). Form 8938 also covers more ground—foreign stocks, partnerships, and life insurance policies count, not just bank accounts.

The biggest mistake? Thinking one form replaces the other. If you meet both thresholds, you file both forms. No exceptions. And FBAR penalties hit harder than Form 8938 penalties, especially if the IRS thinks you skipped filing on purpose.

| Requirement | FBAR (FinCEN Form 114) | FATCA (Form 8938) |

|---|---|---|

| Threshold | $10,000 in aggregate foreign accounts | $50,000 (single) / $100,000 (married filing jointly) |

| Where to File | With FinCEN (BSA E-Filing System) | With the IRS (as part of tax return) |

| What It Covers | Foreign bank and investment accounts | Foreign financial assets, including stocks, bonds, and partnerships |

| Penalties | Up to $10,000 for non-willful violations; severe criminal fines for willful violations | $10,000 per failure to file; additional penalties if unreported assets generate income |

How FBAR Compliance Affects U.S. Expats and Businesses

Many U.S. expats, dual citizens, and foreign business owners are unaware of their FBAR filing obligations, leading to unintentional non-compliance and IRS penalties.

FBAR Requirements for U.S. Expats

U.S. citizens living abroad must report all foreign financial accounts exceeding the $10,000 threshold, even if:

- Their income is earned and taxed in a foreign country

- They use foreign banks exclusively for daily expenses

- They have joint accounts with a foreign spouse

Failing to file an FBAR can trigger IRS audits and penalties, especially for expats who also claim the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC) on their U.S. tax returns.

FBAR Requirements for Businesses and Trusts

U.S.-based businesses and trusts must also comply with FBAR rules if they own, control, or have signature authority over foreign financial accounts. Entities such as LLCs, corporations, and partnerships that hold foreign accounts exceeding $10,000 must file FinCEN Form 114 annually.

If multiple individuals have signature authority over the same account (e.g., corporate bank accounts), each person may be required to file a separate FBAR report.

How FBAR Reporting Interacts with Other IRS Forms

FBAR compliance is often linked to other international tax reporting requirements. Failing to file one form properly may trigger IRS scrutiny on related filings.

Other Related IRS Forms

U.S. taxpayers with foreign assets or investments may also need to file:

- Form 5471 – For ownership in a foreign corporation

- Form 3520/3520-A – For foreign trusts or inheritances from non-U.S. persons

- Form 8865 – For U.S. taxpayers who own part of a foreign partnership

Failing to file these forms increases audit risk and may lead to additional penalties.

Common Mistakes to Avoid When Filing FBAR

- Failing to report small foreign accounts – Even if an account holds less than $10,000 individually, if the total of all accounts exceeds $10,000, FBAR filing is required.

- Misclassifying foreign retirement accounts – Some foreign retirement plans require FBAR reporting, while others may be exempt. Consult a tax professional.

- Not converting balances to U.S. dollars correctly – Always use the official IRS exchange rate for the year.

- Assuming joint accounts don’t need reporting – If you are a co-owner or have signature authority, the account must be reported.

Proper tax planning and compliance can help avoid unnecessary penalties and scrutiny.

Best Practices to Stay Compliant

To simplify FBAR compliance:

- Keep detailed records of all foreign accounts throughout the year

- Document account balances and relevant transactions

- Use official exchange rates for all conversions

- Set annual reminders for the April 15 filing deadline

- Consult a tax professional for unusual or complex cases

By following these practices, you reduce your risk of penalties and ensure you remain compliant year after year.

Frequently Asked Questions About FBAR Filing

Who is considered a ‘U.S. person’ for FBAR purposes?

A U.S. person for FBAR purposes includes U.S. citizens, green card holders, resident aliens, and entities like corporations, partnerships, LLCs, trusts, and estates formed under U.S. law. Non-U.S. citizens who meet the substantial presence test also qualify as resident aliens and must file FBAR. This definition is broader than many people realize—even if you weren’t born in the U.S., you may still have FBAR filing obligations based on your residency status. If you’re unsure whether you qualify as a U.S. person, contact Silver Tax Group for a compliance review.

What is the $10,000 threshold for FBAR filing?

The $10,000 FBAR threshold refers to the combined maximum value of all your foreign financial accounts at any point during the calendar year. If your foreign accounts totaled $10,000 or more for even a single day, you must file an FBAR. This is an aggregate calculation—even if no individual account exceeds $10,000, you must add them together. For example, if you have a $6,000 account in Canada and a $5,000 account in Germany, your $11,000 total triggers the filing requirement. The threshold applies to the highest combined balance reached during the year, not just the year-end balance.

When is the FBAR filing deadline?

The FBAR filing deadline is April 15 each year for the previous calendar year’s foreign accounts. FinCEN automatically grants a six-month extension to October 15, so you don’t need to request additional time. Unlike tax return extensions, the FBAR extension is automatic and requires no separate filing. However, waiting until October increases your risk of missing the deadline entirely. Filing by the April deadline gives you peace of mind and keeps you compliant. Need help meeting the deadline? We can help you file accurately and on time.

What are the civil and criminal penalties for non-compliance?

FBAR penalties depend on whether the IRS considers your violation willful or non-willful. Non-willful violations can result in penalties up to $10,000 per unreported account per year. Willful violations carry much steeper consequences: the greater of $100,000 or 50% of the account balance for each violation. In extreme cases, the IRS can pursue criminal charges, which may include fines up to $500,000 and up to 10 years in prison. Each year you fail to file counts as a separate violation, so penalties can accumulate quickly. If you’ve missed past FBAR filings, voluntary disclosure programs may reduce your penalties. Learn about IRS voluntary disclosure options to resolve past non-compliance.

How can Silver Tax Group help with my FBAR filing?

Silver Tax Group provides comprehensive FBAR compliance services, from determining your filing requirements to submitting FinCEN Form 114 on your behalf. Our tax attorneys review your foreign accounts, calculate the highest balances, convert foreign currencies accurately, and ensure timely electronic filing through the BSA E-Filing System. We also help clients who missed past filings by navigating IRS voluntary disclosure programs and negotiating penalty reductions. With over 40 years of combined tax law experience, we handle every aspect of FBAR compliance so you can avoid costly mistakes.

File With Confidence

For U.S. taxpayers with foreign accounts, FinCEN Form 114 (FBAR) is a mandatory annual filing requirement. Non-compliance can lead to severe financial penalties and potential IRS criminal charges. As IRS enforcement intensifies, it is critical to file FBAR accurately and on time.

To ensure full compliance and avoid penalties:

- Review all foreign financial accounts to determine if FBAR is required

- File FinCEN Form 114 electronically through the BSA E-Filing System

- Report all required information accurately to prevent IRS audits

- Consult a tax attorney if you have past non-compliance issues

For expert FBAR filing assistance, IRS offshore penalty defense, and tax compliance strategies, contact Silver Tax Group today. Our experienced tax attorneys can help you navigate complex foreign bank account reporting requirements and protect your financial interests.