After 15 years of practicing tax law, I can tell you that few IRS filings carry the financial consequences of IRS Form 706, the federal estate tax return used to report and calculate estate tax obligations. I’ve guided families through estates ranging from $15 million to over $100 million, and the difference between proper and improper filing can mean millions of dollars in unnecessary taxes, penalties, or lost opportunities for wealth transfer. What makes this particularly challenging is that you’re navigating this complexity during one of the most difficult times in your life – immediately following the loss of a family member.

What Is IRS Form 706 and When Must You File the Estate Tax Return?

IRS Form 706, formally known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of a deceased person’s estate and calculate any federal estate tax owed to the IRS. For individuals dying in 2026, you must file if the gross estate plus adjusted taxable gifts exceeds $15 million. This represents the estate tax exemption after the One Big Beautiful Bill Act permanently set the exemption at $15 million starting January 1, 2026, eliminating the previously scheduled sunset that would have cut the exemption in half.

Understanding “gross estate” is critical because this trips up many families. The gross estate includes everything the decedent owned or had certain interests in at death – real estate wherever located, bank accounts, investment accounts, retirement accounts, life insurance proceeds if the decedent owned the policy or named their estate as beneficiary, business interests, personal property, vehicles, collections. You also add back certain gifts made during life that exceeded the annual exclusion amount.

Here’s a scenario I see frequently. A family comes to me thinking they don’t need to file because they “only” had a house worth $2 million, a 401(k) with $800,000, and some bank accounts. Then we discover a $4 million life insurance policy, an inherited IRA worth $1.2 million, $8 million gifted to an irrevocable trust years ago, and several rental properties totaling $3 million. Suddenly we’re looking at a gross estate over $19 million, and Form 706 is absolutely required.

The Portability Election: Why Smaller Estates File Too

Here’s what many people miss – you should file Form 706 even if the estate is under $15 million if there’s a surviving spouse and you want to elect portability. This election allows the surviving spouse to use any unused portion of the deceased spouse’s exemption, potentially saving millions in future estate tax. From an IRS compliance perspective, the portability election on Form 706 is one of the most valuable—and most frequently misunderstood—estate tax planning opportunities available to surviving spouses.

Let me explain why portability matters through a real example from my practice. A husband died with an estate of $6 million, all passing to his wife. Because of the marital deduction, there was no estate tax owed. The executor didn’t file Form 706 because “there’s no tax due.” The wife later inherited money from her parents, sold appreciated real estate, and when she died, her estate was $18 million. Because Form 706 wasn’t filed for her husband, she only had her own exemption. Her estate owed approximately $1.6 million in unnecessary federal estate tax.

If the executor had filed Form 706 for the husband to elect portability, the wife would have had his unused exemption plus her own – potentially a combined exemption of over $25 million. Her $18 million estate would have owed zero tax. The portability election turns what seems like a simple administrative task into a multi-million dollar decision.

The IRS generally allows late portability elections under Revenue Procedure 2022-32 for estates that weren’t required to file, but only within specific timeframes – typically up to five years after death. The return must include specific language citing the revenue procedure and must be complete and properly prepared. However, why risk complications or potential rejection? If there’s a surviving spouse, file Form 706 timely and elect portability.

IRS Form 706 Filing Deadlines and Extension Rules

Form 706 must be filed within nine months of the date of death. If someone dies January 15, 2026, Form 706 is due October 15, 2026. The IRS enforces a strict deadline for Form 706 – miss it and you face penalties, interest, and potentially lose the portability election permanently.

You can request a six-month automatic extension by filing Form 4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes. This extends the filing deadline to 15 months after death. However, the extension is only for filing, not for payment. Any estate tax owed must still be paid by the original nine-month deadline, or you’ll owe interest on the unpaid balance from the due date.

I recommend requesting the extension in almost every case. Estate administration is unpredictable – appraisals take longer than expected, documents are missing, beneficiaries disagree about values, assets are discovered that weren’t initially disclosed. That six-month cushion provides invaluable flexibility and doesn’t create any penalty as long as you’ve paid the estimated tax by the nine-month deadline. The extension also gives you more time to gather documentation, obtain professional valuations, and make informed decisions about elections.

Understanding the Generation-Skipping Transfer Tax

Form 706 also calculates the generation-skipping transfer tax (GST tax) – a separate 40% tax that applies when assets transfer to someone who is two or more generations below the transferor, typically grandchildren or great-grandchildren. Congress created this tax in 1986 to close a loophole where wealthy families transferred assets directly to trusts for grandchildren, skipping their children’s generation entirely and avoiding one layer of estate tax.

The GST tax has its own $15 million exemption in 2026, equal to the estate tax exemption. But here’s the complexity – you must carefully allocate this exemption to specific assets or trusts to avoid the tax. The allocation must be made on a timely filed Form 706, and once allocated, it’s permanent. Improper GST exemption allocation is one of the most costly mistakes I see in estate administration.

Here’s why this matters practically. Say your parent dies leaving $30 million in a trust for the benefit of their children during their lifetimes, with the remainder going to grandchildren when the last child dies. This is a dynasty trust structure designed to benefit multiple generations. If GST exemption isn’t properly allocated to this trust on Form 706, when the assets eventually pass to grandchildren – potentially decades later – they’ll face a 40% GST tax on top of any estate tax. On a $30 million trust growing to $60 million by the time it reaches grandchildren, improper GST planning could cost $24 million in unnecessary tax.

The Documentation You Actually Need

Filing Form 706 requires extensive documentation and gathering it takes far longer than most executors expect. You need the death certificate – an official certified copy, not a photocopy. The IRS requires this attached to the return. You need the will (if one exists), all trust agreements, and any amendments. These documents show who gets what and how the estate should be administered.

The IRS expects complete, well-documented support for every asset reported on Form 706, and missing documentation is a common trigger for estate tax audits. For every asset, you need documentation showing value as of the date of death. For real estate, that means professional appraisals from qualified appraisers – typically costing $500 to $3,000 per property. For publicly traded stocks and bonds, you need the closing prices on the date of death, which you can get from brokerage statements. For closely held business interests, you need detailed business valuations from qualified valuation professionals. These can take months to complete and cost tens of thousands of dollars, but they’re essential to defend your reported values under IRS scrutiny.

You need copies of all gift tax returns (Form 709) ever filed by the decedent. Lifetime gifts affect the estate tax calculation even though they’re not in the estate anymore, because the estate tax is actually a cumulative tax on lifetime and death transfers combined. If the decedent made large gifts but never filed gift tax returns, you have a serious problem that needs immediate attention from experienced tax counsel.

You need bank and brokerage statements as of the date of death, insurance policy information including beneficiary designations and death benefit amounts, retirement account statements showing values and beneficiaries, mortgage documents, loan agreements, documentation of all debts owed by the estate, property tax bills, and income tax returns for at least the last three years. If the decedent owned business interests, you need business financial statements and tax returns.

Start gathering information immediately. Don’t wait until you think you’re ready to prepare the return. Tracking everything down takes far longer than you expect, and the nine-month deadline arrives quickly.

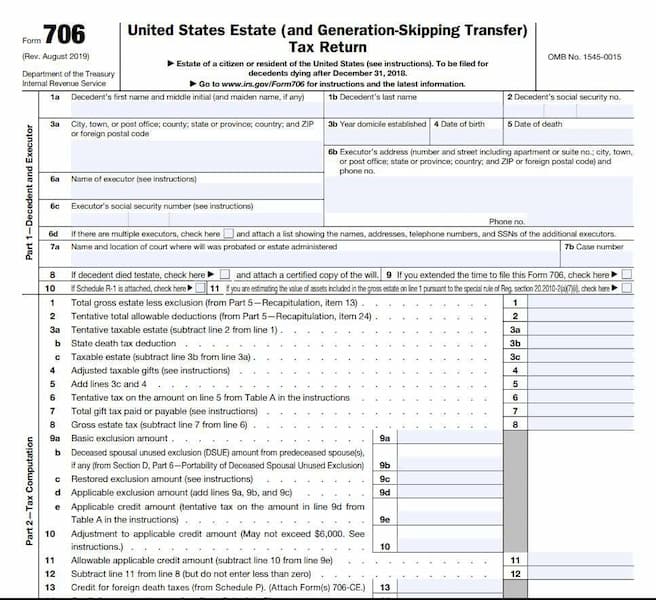

The Six Parts and 19 Schedules of Form 706

Form 706 includes six parts and 19 supplemental schedules, making it one of the most complex tax forms the IRS requires. Part 1 covers basic information about the decedent and executor – names, Social Security numbers, dates, addresses. Part 2 is where you calculate the actual tax – starting with gross estate value, subtracting allowable deductions, adding back lifetime gifts, calculating tentative tax, then subtracting applicable credits. One error in Part 2 cascades through the entire form.

Part 3 addresses critical elections. Do you elect special-use valuation under Section 2032A for farm or business property, which can significantly reduce the taxable value? Do you elect to pay estate tax in installments under Section 6166? Do you elect to defer tax on remainder interests? Each election has specific requirements, deadlines, and tax consequences that require careful analysis based on your family’s specific situation.

Part 4 asks detailed questions about the estate that determine which schedules you must complete. Did the decedent have business interests? Were there any transfers that might be includible under Sections 2035 through 2038? Did the decedent create any trusts during life? Were there any foreign assets or accounts? Your answers trigger additional schedules and documentation requirements.

Part 5 is your summary of the gross estate – you total the values from each schedule to arrive at the gross estate value that flows to Part 2 for the tax calculation. Part 6 handles portability – either computing the Deceased Spousal Unused Exclusion (DSUE) amount that transfers to the surviving spouse, or affirmatively opting out of the portability election.

The 19 schedules require specific, detailed asset reporting. Schedule A covers real estate with complete legal descriptions, locations, acquisition dates, and date-of-death values. Schedule B lists every stock and bond separately with CUSIP numbers, share quantities, and values. Schedule C reports mortgages, notes, and cash. Schedule D covers life insurance – critically, even policies not included in the gross estate must be reported, which trips up many executors.

Schedule E addresses jointly owned property. Schedule F reports other miscellaneous property – artwork, vehicles, jewelry, household contents, digital assets, cryptocurrency, intellectual property. Schedules G, H, and I deal with lifetime transfers and powers of appointment. Schedules J through M cover deductions – funeral expenses, administrative expenses, debts, mortgages, and the marital deduction. Schedules O through R cover credits and special tax situations. Schedule R-1 handles the critical GST tax calculation.

Common IRS Form 706 Mistakes That Trigger Estate Tax Audits

Missing the filing deadline tops the list of costly mistakes. Late filing means penalties of 5% per month up to 25% of the tax due, plus interest compounding daily. For a $2 million tax bill, that’s $500,000 in penalties alone. Worse, late filing can permanently forfeit the portability election, costing a surviving spouse millions in lost exemption.

Inadequate valuations essentially guarantee an IRS audit and frequently result in significant adjustments. Using Zillow estimates instead of professional appraisals for real estate, having the decedent’s business partner value business interests, or relying on outdated appraisals invites IRS challenge. The IRS maintains a stable of expert appraisers specifically to challenge estate valuations, and they’re quite effective.

I’ve seen estates that undervalued assets by 30% to 40% face not just additional tax and interest, but accuracy-related penalties of 20% to 40% of the underpayment. On a $5 million undervaluation resulting in $2 million of additional tax, the penalty alone could be $400,000 to $800,000.

Incomplete reporting causes serious problems. Failing to list all gifts on Schedule G, not reporting foreign accounts or assets, omitting life insurance policies, forgetting about digital assets or cryptocurrency – these omissions create audit risk and potential penalties. The IRS increasingly uses third-party data matching from banks, brokerages, and state departments of revenue. If your return doesn’t match their records, expect an audit and detailed questions.

Improper GST exemption allocation can cost families millions, though the tax won’t be due until assets pass to skip persons, potentially decades later. Not allocating any exemption to dynasty trusts, allocating it inefficiently so some trusts are fully exempt while others receive no exemption, or failing to make qualified severance elections when beneficial creates unnecessary future GST tax liability.

Incorrect portability election language is another expensive mistake. The IRS has specific requirements for the language used and the calculations required. Using the wrong language, failing to properly compute the DSUE amount, or not completing Part 6 correctly can result in the IRS rejecting the portability election. The surviving spouse then loses millions in exemption that could have sheltered future gifts or their own estate.

State Estate Taxes Add Another Layer

Federal Form 706 is only part of the picture. Twelve states plus the District of Columbia impose their own estate taxes – Connecticut, Hawaii, Illinois, Maine, Maryland, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont, and Washington. Many have exemption thresholds far below the federal $15 million, ranging from $1 million in Oregon to $13.61 million in Connecticut.

Some states have inheritance taxes instead of or in addition to estate taxes. Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania impose inheritance taxes on beneficiaries based on their relationship to the decedent. These are separate from estate taxes and require different returns with different deadlines.

If the decedent owned real estate in multiple states, you may need to file estate tax returns in each state where property was located. If the decedent was a resident of one state but owned a vacation home in another, both states may claim the right to tax certain assets. This creates complex apportionment issues requiring experienced counsel familiar with multi-state estate taxation.

Why Professional Help Isn’t Optional

Form 706 is not a DIY project, and I don’t say that to generate business – I say it because I’ve seen the devastating consequences when executors try to file without specialized help. The financial stakes are too high, the rules too complex, and the consequences of errors too severe. Even accountants and attorneys who don’t specialize in estate tax often refer Form 706 preparation to specialists, because the form is that technical and the risks that substantial.

An experienced estate tax attorney brings critical advantages. We know how to value assets properly and work with qualified appraisers who can defend their valuations under IRS scrutiny. We understand which elections benefit your specific situation and the deadline for making each election. We know how to structure the return to minimize audit risk while maximizing legitimate tax benefits. We can identify planning opportunities even after death – such as qualified disclaimer strategies that shift assets to save taxes, or basis adjustment elections that reduce future capital gains.

Most importantly, we can handle IRS audits and disputes if they arise, protecting your family’s interests and negotiating favorable resolutions. Estate audits are particularly complex and can last years. Having counsel who has successfully defended hundreds of estate returns through audits, appeals, and Tax Court litigation is invaluable.

The cost of professional help – typically $10,000 to $50,000 depending on estate size and complexity – is trivial compared to the tax at stake. A $30 million estate faces potential tax of $6 million on amounts over the $15 million exemption at the 40% rate. Proper planning, reporting, and elections can easily save multiples of the professional fees, while mistakes can cost millions.

Get Expert Guidance for Your Estate Filing

Form 706 isn’t just about numbers and tax calculations. It’s about protecting your family’s legacy and honoring your loved one’s wishes. It’s about making sure assets pass to the right people with the right tax treatment. It’s about avoiding mistakes that create family conflict or unnecessary tax burdens for generations. Because IRS Form 706 governs both estate tax liability and future exemption planning, mistakes on this return can have financial consequences that extend well beyond the initial filing.

At Silver Tax Group, I’ve helped families navigate Form 706 for estates ranging from $15 million to over $100 million. I understand the valuation issues that trigger audits, the elections that maximize tax savings, the portability rules that protect surviving spouses, and the GST planning that preserves wealth for grandchildren. I’ve successfully defended estate returns through IRS audits and appeals, negotiated favorable settlements, and litigated cases in Tax Court when necessary.

If you’re facing the need to file Form 706, don’t wait until the deadline is approaching to seek help. Contact Silver Tax Group today for a confidential consultation. We’ll review your specific situation, explain your obligations and options, help you gather necessary documentation, and prepare an accurate, audit-resistant return that protects your family’s interests. Call us at (855) 900-1040 or visit our website to schedule your consultation. With over $128 million saved for our clients from IRS matters, we have the proven track record and specialized expertise your family needs during this difficult time.

Frequently Asked Questions: IRS Form 706

IRS Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return used by an estate’s executor to report and calculate federal estate tax liability.

An estate must file Form 706 if the decedent’s gross estate, plus adjusted taxable gifts and exemptions, exceeds the federal estate tax threshold or if an election for deceased spousal unused exclusion (portability) is made.

Form 706 is generally due nine months after the date of death. Executors may request a six-month extension using IRS Form 4768.

Late filing can result in penalties and interest on any estate tax owed, and missing portability elections may forfeit unused exclusion amounts. (This aligns with standard IRS penalty considerations based on the requirement to file timely.)

You can download the official IRS Form 706 PDF directly from the IRS website.

Filing Form 706 may be required to elect portability of a deceased spouse’s unused federal estate tax exclusion, which can benefit the surviving spouse’s future estate planning.