After 15 years representing taxpayers before the IRS, I’ve watched thousands of clients wait anxiously for their refunds. Some need those funds immediately to pay bills. Others want to split the money between spending and savings. Most don’t realize there’s a simple IRS form that solves these problems – Form 8888, Allocation of Refund.

Form 8888 lets you direct deposit your refund into up to three different accounts and receive your money weeks faster than any other method. And starting in 2026, direct deposit isn’t just faster – it’s essentially required. The IRS eliminated paper refund checks for most taxpayers effective October 2025, making Form 8888 more important than ever for managing your refund. The form takes about five minutes to complete, but I regularly see mistakes that delay refunds by months. Let me show you exactly how Form 8888 works in 2026 and the errors to avoid.

What Form 8888 Does and Why It Matters in 2026

Form 8888 tells the IRS how to split your tax refund among multiple accounts. Without it, you can only direct deposit your entire refund into a single account. Form 8888 expands your options – split between up to three accounts, send part to checking and part to savings, direct portions to specialized accounts like IRAs or HSAs, or combine these options.

The form requires your bank routing numbers, account numbers, account types, and the dollar amounts for each deposit. The amounts must total your expected refund exactly. The IRS processes Form 8888 with your tax return. If everything matches, they direct deposit the specified amounts. If something doesn’t match, they typically deposit your entire refund into the first valid account listed.

I’ve seen Form 8888 save clients in genuine emergencies. One client owed $8,000 in back property taxes with a foreclosure deadline days after their expected refund date. We filed electronically with Form 8888 directing the full refund to checking. The direct deposit arrived in 12 days. They paid the property taxes two days before the deadline and saved their home.

Critical 2026 Changes You Need to Know

Two major changes affect Form 8888 in 2026. First, the IRS eliminated paper refund checks for most taxpayers starting October 2025 under Executive Order 14247. Direct deposit is now mandatory unless you qualify for specific exceptions like lack of banking access or certain disabilities. Paper checks were 16 times more likely to be lost or stolen than electronic payments, and they took six weeks or longer versus 10-21 days for direct deposit. During 2025, 93% of refunds were already issued via direct deposit, so this change affects a relatively small percentage.

Second, you can no longer purchase U.S. Series I Savings Bonds with your refund through Form 8888. The IRS and Treasury discontinued the Tax Time Savings Bond program effective January 1, 2025. The December 2025 revision of Form 8888 removed the savings bond section entirely. Only about 35,000 taxpayers per year used this option. If you want I Bonds, purchase them directly through TreasuryDirect.gov, where you can buy up to $10,000 in electronic bonds per person per calendar year.

When You Should Use Form 8888

Form 8888 makes sense when you’re receiving a refund of $1,000 or more and want to automatically split it between spending and savings. If you have bills due within two to three weeks and need your refund quickly, direct deposit through Form 8888 typically arrives 10-21 days after e-filing. If you’re splitting a refund between spouses with separate accounts, or directing part to a joint account and part to individual accounts, Form 8888 handles multiple deposits that standard direct deposit cannot.

I particularly recommend Form 8888 for taxpayers who historically spend their entire refund immediately. The forced split – sending part to checking and part to a savings account you don’t regularly access – creates automatic savings. I’ve had clients save $30,000+ over several years by directing 50% of each refund to separate savings via Form 8888.

2026 Tax Season Timing

The IRS expects to begin accepting 2025 tax returns in late January 2026, likely around January 26. When you e-file with direct deposit, most refunds arrive 10-21 days after the IRS accepts your return. Early filers who submit returns in late January or early February typically experience the fastest processing. The 2026 season may face delays given IRS staffing changes and implementation of provisions from the One Big Beautiful Bill Act, making early filing even more important.

Special note: If you claim the Earned Income Tax Credit or Additional Child Tax Credit, federal law requires the IRS to hold your entire refund until at least mid-February regardless of when you file. The IRS expects to release the first wave of these refunds by early March 2026, provided there are no issues with your return and you used direct deposit.

How to Fill Out Form 8888 Correctly

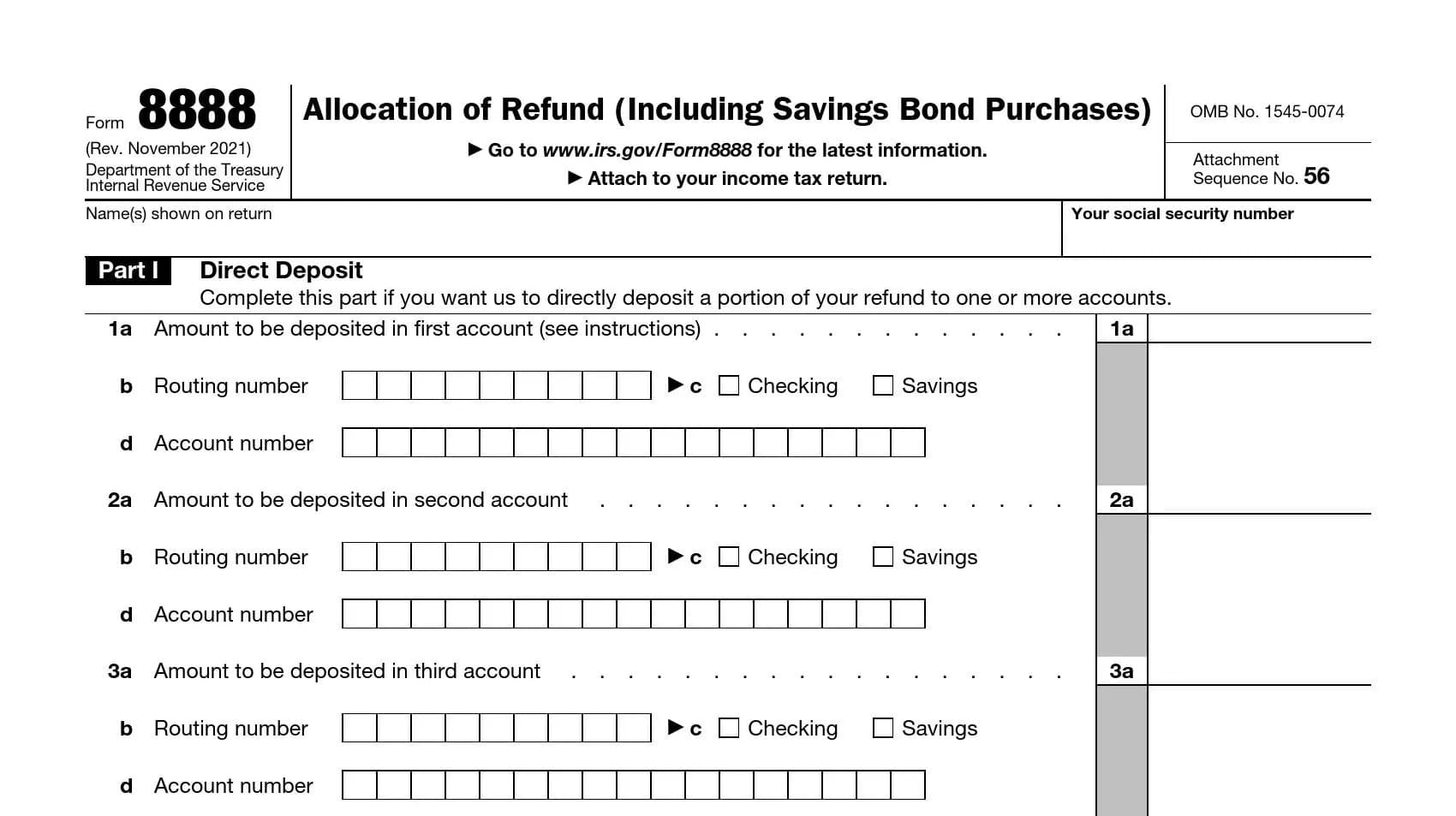

Before starting, gather your bank routing numbers, account numbers, account types, and calculate exactly how much you want in each account. The December 2025 revision simplified Form 8888 by removing the savings bond section. The form now has two parts – Part I for direct deposits (lines 1, 2, and 3 for up to three accounts) and Part III for totals.

For each account line in Part I, enter the routing number (nine digits identifying your bank), account number, account type (checking or savings), and dollar amount. In Part III, line 4 asks for your total allocations. Line 5 asks for your total refund from your tax return. These must match exactly. If they don’t, the IRS will deposit your full refund into the first account listed rather than splitting it as you intended.

All accounts must be in your name, your spouse’s name (if filing jointly), or a joint account. You cannot direct deposit into accounts belonging to other people, even family members. The IRS verifies account names match the taxpayers on the return.

Common Mistakes That Delay Refunds

The most common error is mismatched totals. Taxpayers allocate $3,000 to checking and $2,000 to savings (total $5,000) but their actual refund is $4,800. The IRS deposits the full $4,800 into the first account, defeating the split entirely. Double-check your math and verify your expected refund amount matches your Form 8888 total.

The second error is wrong account or routing numbers. Transposing digits, using numbers from a closed account, or copying from the wrong account all create problems. When deposits fail, the IRS deposits to the first valid account or delays your refund. Always verify numbers directly from your bank’s website or by calling your bank.

The third error is attempting splits to accounts not in your name or your spouse’s name. You cannot deposit into your child’s account, parent’s account, or business partner’s account. The IRS rejects these and may delay your entire refund.

The fourth error is exceeding the three-deposit-per-account-per-year limit. The IRS allows only three direct deposit refunds into any single account per calendar year. If you’re using accounts that received deposits from other returns, verify they haven’t hit this limit.

The fifth error is not accounting for offsets. If you owe back taxes, child support, or student loans, the IRS offsets your refund before sending it. If your return shows a $5,000 refund but you owe $3,000 in back taxes, you only receive $2,000. Form 8888 allocations based on $5,000 won’t work. The IRS uses a “bottom-up rule” – they deduct offsets from the last account listed first, then work backward if necessary.

What Happens After You File

When you e-file, you receive confirmation within 24-48 hours that the IRS accepted your return. After acceptance, the IRS reviews your return, verifies income, checks for offsets, and validates your Form 8888 accounts. You can track your refund using “Where’s My Refund?” on IRS.gov or the IRS2Go app. The tool updates once daily, typically overnight.

Direct deposits appear in your accounts 10-21 days after acceptance for most taxpayers. If you split your refund among multiple accounts, all deposits arrive the same day. If Form 8888 fails – mismatched totals, invalid accounts, rejected deposits – the IRS typically deposits your refund into the first valid account listed. You’ll see the final deposit location in “Where’s My Refund?”

When Form 8888 Won’t Work

You cannot use Form 8888 if you’re not receiving a refund. You cannot split into more than three accounts. You cannot deposit into foreign bank accounts – routing numbers must be valid U.S. bank routing numbers. You cannot deposit into accounts not in your name or your spouse’s name if filing jointly.

You cannot amend Form 8888 after filing. If you realize you made an error after filing, you cannot fix it. The IRS processes the form as filed. You cannot use Form 8888 with amended returns – it only works with original returns.

Joint Returns and Form 8888

Married couples filing jointly have flexibility. Either spouse can provide account information for any of the three accounts. Accounts can be in one spouse’s name, the other spouse’s name, or joint accounts, as long as the account name matches one taxpayer on the return.

You might direct 50% to your individual checking and 50% to your spouse’s individual savings. Or split among your joint account, your individual account, and your spouse’s individual account. Form 8888 handles these arrangements as long as account names match taxpayers on the return.

State Refunds Are Separate

Form 8888 only controls federal refunds. State refunds are handled through your state return. Most states offer direct deposit but don’t use Form 8888. You enter direct deposit information directly on the state return. Some states allow refund splitting similar to Form 8888, others offer only single-account deposit.

Federal and state refunds won’t arrive simultaneously. Federal refunds via Form 8888 typically arrive within three weeks if you e-file early. State refunds vary dramatically – some states process within two weeks, others take two months or longer.

Preventing Failed Direct Deposits

The best approach is prevention. Copy your routing and account numbers directly from your bank’s website or app. Call your bank to confirm the account is open and in good standing. Verify the name on the account matches your tax return exactly. These simple checks prevent most failures.

If deposits fail, the IRS deposits to the first valid account or delays your refund. Once deposited, you cannot request they retry with different accounts. You’ll need to move money yourself if it didn’t go where intended.

Form 8888 vs. Standard Direct Deposit

Every tax return includes lines for direct deposit – routing number, account number, account type. These lines only allow one account for your entire refund. If you want your entire refund in a single account, use those lines. You don’t need Form 8888.

Form 8888 is only necessary when you want to split your refund among multiple destinations. Using it for single-account deposits adds unnecessary complexity. Processing time is identical whether you use standard direct deposit lines or Form 8888 for a single account.

When Professional Help Makes Sense

Most taxpayers can complete Form 8888 without professional help. The form is straightforward, instructions are clear, and math is simple. However, certain situations benefit from professional guidance. If you’re receiving a very large refund ($25,000+) and want strategic splits for tax planning, a tax attorney can structure optimal allocations.

If you have complex issues including offsets, prior year disputes, or levy concerns, professional help ensures Form 8888 is filed correctly and your refund reaches intended accounts. If you’re filing jointly but separating or divorcing and need to control where your portion goes, a tax attorney can structure Form 8888 to protect your interests.

If you’ve had past IRS problems – rejected refunds, fraud alerts, identity theft – professional assistance navigates complications while ensuring Form 8888 works correctly. If you’re uncertain about 2026 changes including paper check elimination and savings bond discontinuation, professional guidance provides clarity.

At Silver Tax Group, I help clients optimize refund strategies including Form 8888 allocations, particularly when refund amounts are substantial or tax situations involve complications that could delay or redirect refunds. With 2026 changes to refund delivery methods, proper planning becomes even more critical.

If you’re expecting a significant refund in 2026 and want to ensure it’s deposited correctly and quickly, or if you have complex tax issues that might affect your refund processing, contact Silver Tax Group today. We’ll review your situation, help you complete Form 8888 correctly, and make sure your refund strategy aligns with your financial goals while navigating the new 2026 requirements. Call us at (855) 900-1040 or visit our website to schedule your consultation. With over $128 million saved for our clients from IRS matters, we have the expertise to handle even the most complex refund situations.

Frequently Asked Questions: IRS Form 8888

IRS Form 8888 is the official form used to instruct the IRS to split your tax refund into up to three direct deposit accounts, or between direct deposit and a paper check.

Yes. You can attach Form 8888 to your federal tax return to allocate your refund into multiple accounts or mix direct deposit with a paper check.

According to the IRS, splitting your refund using Form 8888 will not delay the deposit timeline; direct deposit transactions generally reach accounts faster than paper checks.

You can deposit your refund into up to three accounts via Form 8888 as long as each account meets IRS eligibility criteria.

If you forgo direct deposit, the IRS may issue a paper check. However, direct deposit via Form 8888 is faster and avoids mailing delays.

The IRS provides Form 8888 and detailed instructions on its official site, including how to allocate refunds and fill out each section.