Key Takeaways:

• Understanding tax obligations as they relate to health care can be complex.

• To waive the penalty for not having health insurance coverage, taxpayers had to file IRS Form 8965 with their annual tax returns before 2019.

• The Tax Cuts and Jobs Act of 2017 eliminated this penalty starting in 2019, making Form 8965 no longer applicable for that year and beyond.

• Low income earners, those who cannot afford the cost of insurance coverage, American Indians or members of federally recognized tribes may qualify for exemptions from filing Form 8965 if it is still required by law depending on their situation.

• There are five steps necessary to properly fill out and submit form 8965

• Our team provides expertise regarding any questions related to taxes including audits, unfiled back taxes or filing tax forms, such as Form 8965

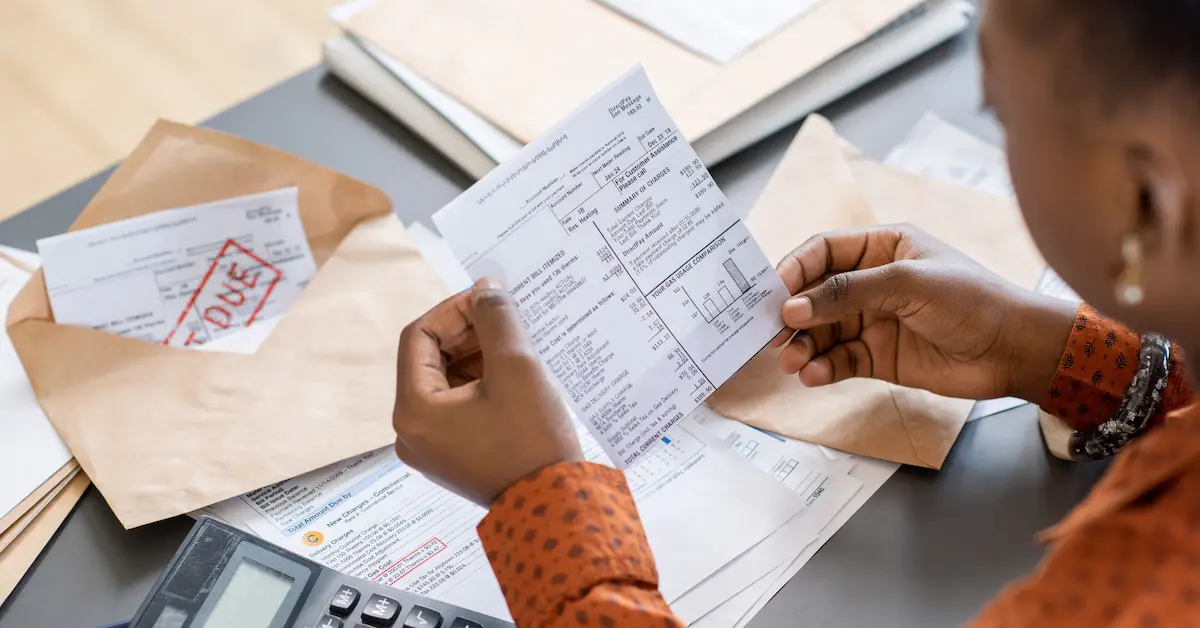

Understanding your tax obligations as they relate to health care can be complicated. You may need to file additional tax forms, depending on your situation. You will use IRS Form 8965 to claim a health care coverage exemption on your tax return for tax years before 2019.

The Affordable Care Act (ACA) made it mandatory for all Americans to have health insurance, and those without it had to pay a penalty. The IRS designed Form 8965 for taxpayers to claim an exemption to waive this penalty if they didn’t have health insurance coverage and file it with their annual tax returns. Taxpayers with insurance coverage, whether from the marketplace or their employer, didn’t have to file this form since they weren’t subject to the penalty.

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated this penalty for people without health insurance, and the change went into effect starting in 2019. Form 8965 is thus no longer applicable for tax years 2019 and later.

Taxpayers who need to submit an unfiled tax return from 2018 or before, however, may still need to file Form 8965. This guide will give you a deep dive into who needs this form and all the steps necessary to get it filed.

Determining Factors for Exemptions on Filing Form 8965

IRS Tax Form 8965 exemptions are relief provisions that exist to reduce or eliminate an individual’s shared responsibility payments (SRPs). Individuals can claim an exemption if they meet certain criteria, such as having no minimum essential coverage during the tax year. Exemptions can also be claimed for certain life events, such as getting married or having a baby. Knowing about these exemptions is important in order to avoid SRPs and keep your taxes low.

There are many different exemptions taxpayers may be eligible to claim to opt out of health insurance coverage and not have to pay the IRS penalty. Here are some of the most common categories to be aware of:

Low Income Exemption

You don’t have to pay taxes if your income is below the threshold, and this is an exemption. The income limit for single filers in 2018 was $12,000.

Can’t Afford the Cost

The required contribution must be 8.05% or less of your household income to be considered unaffordable.

Living Abroad

You must have lived in another country or countries for at least 330 days during 12 consecutive months for this exemption.

Tribal Membership

Members of federally recognized American Indian tribes or those who could receive tribal health care services may claim an exemption.

Hardship Exemption

Some taxpayers may not have been able to get health plan coverage because of a hardship. This category includes those who were homeless, victims of domestic violence, evicted from their homes, faced excessive health care bills, or had other reasons keeping them from getting insurance.

Incarceration

Spending time in jail or prison during the applicable tax year would be an exemption.

Health Care Sharing Ministry or Religious Sects

Membership in a health care sharing ministry or religious sect as identified by the health insurance marketplace may exempt taxpayers.

A Household Member Died, Was Born, or Was Adopted

You may be able to claim an exemption in some circumstances if someone in your household died, was born, or was adopted the months before, including the month that the change took place.

5-Step Instructions to Filing Form 8965

1. Find the Right Form

The latest version of Form 8965 can be found on the IRS website.

2. Enter Your Basic Information

Enter your name and Social Security number at the top of Form 8965. This must be accurate to avoid IRS issues.

3. Determine Which Part You Should Complete

There are three parts to Form 8965. The first should be used if you are reporting insurance marketplace-granted exemptions, which you need to apply for in advance with the marketplace. Include the name of the individual you are reporting for, their Social Security number, and the exemption certificate number. Part II is used if your income is below the tax filing threshold. Part III should be completed if your exemptions don’t apply to the first two sections.

4. Enter the Right IRS Code

Part III exemptions require that you use the name and code of the appropriate exemption per the IRS’s designations, which can be found on the Instructions for Form 8965 in a chart.

5. Submit Form 8965 With Your Tax Return

Attach and send Form 8965 with your annual tax return. You only need to submit one form, even if you have more than one exemption to report, using a separate line for each.

Turn to a Tax Expert With Your Questions

Whether or not you need to submit Form 8965 with back taxes will depend on your exemption eligibility and other factors. You can always consult with the team at Silver Tax Group with questions about this form, even though it is no longer being used for tax years 2019 and later. It may still apply to your tax situation before 2019.

The Silver Tax Group team delivers expertise in any tax-related area, including IRS audits, tax fraud, tax defense, emergency tax services, offers in compromise, overdue tax returns, tax debt, and general tax consulting. Reach out to our team to speak to a tax expert about Form 8965 or your unfiled tax returns.