How to Handle the 3 Types of IRS Audits

Why Am I Being Audited?

Your first question, if you’re dealing with an IRS audit, is probably, “Why me?” Most people assume they’re being audited because there’s a significant issue with their tax returns that they overlooked before they filed. The reality is that the IRS may audit you for many different reasons, and it’s not always because they think you’re cheating on your taxes. Here are a few reasons why you may be audited:

The IRS Chooses You Randomly

You may just be the unlucky one the IRS chose for an audit as a random sample.

Comparing Income and Expense Documents

The IRS may want to check the documents you received from an employer against what you reported to ensure everything is in line. This may happen more often if you are self-employed, for example, and have several different income sources and expense categories. You may be audited if the amount on your W2 or 1099 is different from what you claim when preparing your return.

You Have a High Income

Your odds of getting audited are much higher if you have a high income, especially for taxpayers who make $1 million or more each year.

Checking an Income Discrepancy

An income discrepancy on your tax return that shows a mismatch between your employer’s forms and what you report may also be a trigger. The IRS may simply want to clarify and get the issue resolved fast.

You Claim Many Deductions

Taxpayers who take lots of deductions that seem out of the ordinary are often part of an IRS audit. Always make sure you have the proof to back up your deductions. Sometimes just itemizing on its own can trigger an audit. Self-employed individuals and business owners have a higher chance to be audited because they may choose to itemize their deductions instead of taking the standard deduction. Pay close attention to expenses you can deduct and never claim excessive losses unless they’re legitimate and can be proven.

Anything that seems extreme or out of the ordinary on your tax return may prompt the IRS to audit you. Sometimes the issue is minor, though. Work with a tax professional to help you stave off any possibility of a glaring discrepancy when you go to file.

Have You Been Audited? Get Expert Help From a Tax Attorney.

What Are the Three Types of Audits?

There are three types of tax audits, and the IRS has the final say in which one they use. Each is performed using a different method and will always require cooperation on your part. Here is what you need to know about each type:

Correspondence Audit

The first type of audit is called a correspondence audit, and it’s the most common method. Correspondence audits are geared toward tax returns with fewer complications, and the IRS representative can usually perform the audit by mail. A correspondence audit is likely the preferred choice since you won’t need to talk to anyone in person to get it over with.

Correspondence audits are considered the least serious and the easiest to resolve. They typically involve smaller amounts of money and don’t last very long. The IRS may send you a request for additional information about a tax return issue, and all you have to do is send proof that would resolve the issue.

Office Audit

The next type is an office audit, in which you have to take your receipts and documentation to a local IRS office and speak with an agent. This type of audit is common among small-business owners or where a lot of paperwork is involved.

The agent will review everything you reported, take a look at your records, and ensure that income and deductions are all correct. Office audits are meant to ensure that you pay the full amount you owe the IRS.

Field Audit

A field audit is similar to the office method, but the IRS agent instead comes to your home or place of business. Field audits are much more complex, usually requiring an experienced tax professional to represent you. The IRS agent will give you plenty of advance notice if they plan to conduct a field audit so you can prepare and get in touch with someone to assist you.

Field audits can last longer than correspondence or office audits. Sometimes they may take a day or a week, depending on the issue and the records to be reviewed.

Each type of audit has its own requirements, but they should be pretty straightforward, and the IRS will guide you. A tax professional will help you if you find out you will be undergoing an audit so you can prepare for whatever audit type is requested.

IRS Audit Notifications

You will first receive a notice via mail if the IRS chooses your tax return for an audit. They may ask you to schedule an appointment for an interview either by mail, at a local IRS office, or even at your place of business. Here’s what to know:

- The IRS will also tell you what records they need.

- An Information Document Request, also known as Form 4564, is their formal request for backup and other documentation.

- It is always a good idea to hang onto all of your tax returns and relevant records for at least three years after you file, just in case you’re audited.

The IRS will notify you of the audit outcome after it’s over. The result could be that there are no changes or some changes that you agree to. You will be notified of the next steps, even if you disagree with the outcome. You can either pay what you owe or try to appeal the decision, which requires help from a tax attorney.

What to Do if the IRS Is Auditing You

There is no need to be alarmed if you receive a notification from the IRS. Just because you’re being audited does not mean you made a mistake on purpose or that you’ve tried to commit tax fraud. Taxpayers usually make it through the audit fine and often don’t pay any additional taxes or charges.

The sooner you get to work on resolving the issue, however, the less you’ll have to pay in fines, penalties, and interest. A representative from the IRS will let you know when you can schedule an appointment within two weeks of receiving the audit notification. You cannot postpone the date for more than 45 days without the approval of an IRS supervisor.

Make sure to get the name, ID number, and phone number of the IRS contact person you’ve been assigned. It is usually indicated on the top right-hand corner of your official notice. You can also have a professional tax representative call the office on your behalf to schedule the appointment.

6 Helpful Tips When Dealing With the IRS

IRS audits may be quick and straightforward, but there are still some moving parts you need to be aware of. Here are a few tips for when you’re starting the IRS audit process:

Review the Letter Carefully

Your first step is reading through everything in the letter carefully. The IRS will probably give you detailed instructions on the next steps. You don’t want to miss anything important that you need to do to comply with the audit requirements.

Be Prompt

You should always seek the help of an experienced tax professional if you’re aware of a severe problem with your tax returns. Time is critical when dealing with the IRS, so don’t delay.

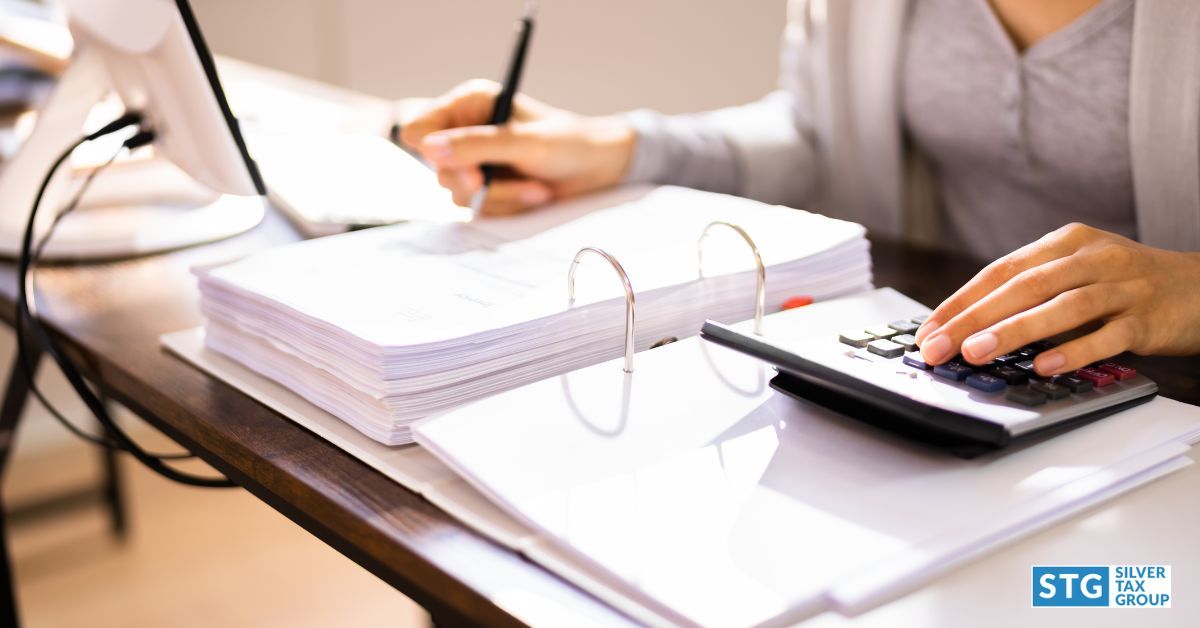

Prepare Your Records

Make sure to gather any documentation and receipts and have everything ready ahead of time, especially if it’s a more detailed audit. Read over everything carefully and be prepared to explain anything that may have caused a red flag. Go over your tax return and make sure your income and expense records match what you reported. Do everything you can to stay organized.

The IRS will also send you the document request form with details of what records they need to review. Gather these documents together and call your tax professional if you need help or have questions.

Get Help When Needed

You can likely deal with the IRS yourself if it comes down to discrepancies in the information. Just make sure you know what they want. You can also interrupt your audit any time you need to and ask for a tax professional’s help if you feel overwhelmed or confused.

Mark Your Calendar

You should receive an official confirmation letter in the mail once you’ve agreed to set an appointment date. This letter will include the location, date, and time you’ve chosen. Make sure you prioritize this meeting and remind yourself in any way that will help you.

Be Responsive and Cooperative

It is easy to become frustrated or defensive if the IRS has made a mistake or if you are confused about why they are contacting you. Remember that the more cooperative you are, the faster the process will go. Do what is asked of you, state your case, provide all necessary information, and be responsive. Any issue you experience with the IRS can be discussed with a tax attorney if necessary.

You may be feeling overwhelmed and afraid if the IRS is auditing you. There is no reason to panic, and audits happen all the time. Your best bet is to stay calm and be thorough and helpful.

How to Handle an IRS Audit

Now let’s briefly walk through what to do if you face any of the three types of audits. Here are the different steps you’ll need to take:

Correspondence Audit

Correspondence audits can be handled entirely through the mail, so you never have to travel anywhere or host an agent at your office. Simply follow the instructions given to you in your notification letter and send back any information that will help you support your case. You may realize you made an error on your tax return, so you’ll need to submit an amendment if that’s the case.

Office Audit

Always be on time for your IRS office appointment. The agent will tell you beforehand what you need to bring, so make sure you organize your files and can present them properly. Government buildings can be a little hard to navigate, so make sure to find out exactly where you need to go so you aren’t late. Dress professionally to represent your business well.

Field Audit

A field audit can be a bit more intimidating than a correspondence audit, since you have to face the IRS representative in person at your place of work. This agent may look for several things when they visit, so it’s crucial that you are fully prepared before they arrive.

IRS auditors are specially trained to pay close attention to the initial interview so they can create a better picture of where you stand financially. This includes both personal and business audits. They pay attention to your willingness to comply as well.

Always be polite and remember that any of the three types of audits are formal interactions. Remain calm and professional. Never lie to the agent about anything, or your situation will only get worse. Be honest and open, even if they ask a question and you don’t know the answer. Simply tell them that you don’t know but can find out.

Dealing With IRS Auditors

Auditors usually ask questions that they already know the answer to so they can determine your trustworthiness and openness. Remember that it’s always best to say you don’t know rather than tell them a lie. A few tips to keep in mind:

- Always keep your answers short, concise, and to the point. Yes and no answers should work fine for most questions. Try not to make small talk, as it could indicate to the auditor that you’re nervous or hiding something.

- Many IRS agents are quiet on purpose to gauge your reactions and body language. Let the agent read over documents or go through files as you wait in silence. Never argue with an agent if they say something you disagree with.

- The process usually wraps up quickly. Just answer everything correctly and stick to the task at hand as much as you can. Consider hiring a tax professional who can represent you and be your advocate if you’re nervous.

A CPA or tax attorney will know how to handle any of the three types of tax audits and communicate on your behalf. That doesn’t mean you should give the auditor the silent treatment. Simply tell them you’ll need to refer to your accountant or lawyer if there are questions you aren’t sure about.

The Odds of Being Audited by the IRS

The odds of being audited are very slim, and depend on your income, claimed deductions, and whether you’re an owner of a small business or are self-employed. Remember to stay calm if you are notified of an upcoming audit. Most personal tax returns are not audited, which means your chances are pretty small unless you own a business. You probably won’t have to deal with an audit from the IRS at all if you do not file a Schedule C with your return.

Audits are most often performed on self-employed people to make sure they’re paying their taxes correctly based on their income. Deductions like a home office, business supplies, and utilities are also scrutinized for small business owners and self-employed people. There is no need to panic if you work for yourself, though. You may never have to deal with any of the three types of audits as long as your income looks reasonable, you’ve paid your quarterly taxes, and you’ve reported expenses accurately.

Don't Want to Face an Audit Alone? Get Expert Help From a Tax Attorney.

Make Your Audit Successful: Contact a Tax Professional With Questions

Getting an IRS audit notice is not the end of the world. The odds of getting audited are small, but it’s always good to know how to handle each type of audit, just in case. Your best bet is to work with a tax attorney who understands tax laws and regulations. The team at Silver Tax Group has successfully represented clients across the country in IRS tax audits.

Reach out to Silver Tax Group to speak to a tax expert. We can help with any of the three types of audits and work for an optimal outcome.