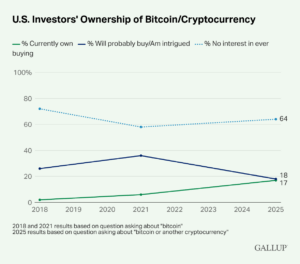

Cryptocurrency is no longer an investment category. It’s a tax event. The IRS has moved beyond policy debates into active enforcement, sending letters to holders they’ve identified across the 36.5 million Americans with virtual currency. If that envelope has landed in your mailbox, stop speculating and start reading.

What starts as understanding your tax obligations ends with protecting your assets, preserving your financial standing, and eliminating the anxiety that comes with federal correspondence.

The IRS Sent Me a Letter Asking for Information—Help!

First, identify your letter type: 6173, 6174, or 6174-A. Each requires a different response. 6174-A is informational.

6174 requests voluntary correction. 6173 demands a signed reply under perjury laws. Before responding, gather all exchange records, wallet histories, and transaction documentation.

Accuracy matters more than speed. When uncertain, consult a tax professional. The deadline exists for your benefit. Use every available day.

Why the IRS is Sending Letters to Cryptocurrency Holders

The letters arriving in mailboxes today are the result of a five-year enforcement pipeline. Here’s how it developed.

Before 2019, the IRS lacked a finalized framework for taxing virtual currencies. Traders bought and sold. Miners generated coins. Holders watched values rise and fall. Few reported these activities because the reporting requirements remained unclear, even to experienced accountants.

Some cryptocurrency owners deliberately avoided disclosure, valuing the privacy and autonomy that decentralized assets promised. Others simply didn’t know what to report or how to report it. The result was identical: millions of taxable events went undocumented.

Then the IRS acted. The agency issued formal guidance clarifying that cryptocurrency qualified as property, making every sale, trade, and exchange a taxable transaction. Compliance did not follow. Years of unreported gains had created a population of taxpayers who either didn’t know about the new requirements or chose to ignore them.

The IRS responded with legal force. Federal agents subpoenaed account records from major trading platforms, including Coinbase, Kraken, and others. These platforms surrendered user data: names, transaction histories, wallet addresses, and trading volumes.

From this data, the IRS built a list. That list generated the letters now landing in mailboxes across the country. The 6173, 6174, and 6174-A correspondence you may have received is not random. It is the direct product of exchange records that the IRS already possesses. They are not asking if you traded cryptocurrency. They are telling you they know you did.

Is Everyone Who Receives a Letter Non-Compliant?

Be aware that these letters from the IRS are a form of blanket communication. Not everyone who receives one of these letters is necessarily non-compliant in their taxes.

This is handy to know if you are sure that you have already reported your earnings accurately. In most of these cases, you will not have to take any action after receiving an IRS letter.

On the other hand, if you have not reported some or all of your cryptocurrency earnings, or have miscalculated them, then you will need to pay attention to the instructions in the letter and follow them.

What to Do if You Receive a Letter about Cryptocurrencies

So, you have this ominous letter from the IRS about your cryptocurrencies.

What do you do?

The first step is to understand the letter type that you received.

Understand the Letter Types the IRS Sends

There are three types of letters the IRS sends regarding cryptocurrency tax reporting. These are 6173,6174, and 6174-A.

The last two, 6174, and 6174-A do not require any action on your part. If you meet all of the crypto tax filing obligations listed in the letter, you do not have to respond to it or amend your return in any way.

The first letter type, however, does require your correspondence. If you do not respond to a 6173 within the given time period your account will likely be audited.

To respond satisfactorily to a 6173, you will need to provide any and all requested documents listed in the letter. If you are having trouble with this, we advise that you seek the help of experienced tax professionals who specializes in cryptocurrency.

Once you have begun dealing with the letter, it is important that you get clear on how exactly cryptocurrencies are taxed

How Cryptocurrencies Are Taxed

Before you proceed, it is wise to understand how exactly cryptocurrencies are taxed. Let’s take a look.

As per IRS guidelines, cryptocurrencies are subject to capital gains tax.

Capital gains tax on its basis is straightforward. The price for which you bought the asset is deducted by the amount for which you sold the asset.

The profit or gain on the sale of the asset then attracts a certain rate of capital gains tax, which is dependant on your tax bracket.

So, for example, in the case of cryptocurrency, if you bought $1,000 of bitcoin when it was $4,000 and sold when it was worth $12,000, you would have made a profit at the time of sale of $3,000.

This sounds simple enough, but it can get quite tricky, as we will explain below.

When Your Letter From the IRS Gets Tricky

Although one can calculate the gain or loss on the sale of most assets with ease, cryptocurrencies are slightly different.

Firstly, unlike something such as buying or selling your house, cryptocurrency transactions are generally more frequent and are more involved from a bookkeeping perspective.

Additionally, cryptocurrencies are not always bought and sold for dollars. If you are investing in altcoins, then you will need to purchase these in bitcoin, which makes working out the dollar gains and losses that much more involved.

For example, say you buy $100 worth of bitcoin. You then decide at a later stage to buy $20 worth of ethereum out of your bitcoin amount.

The next month, ethereum runs, and you, therefore, sell and put half back into bitcoin, and the other half into the Neo network.

The Neo then proceeds to mine gas (a form of rewards particular to this network), which you then sell for Neo once more.

You will have to calculate any profit or loss then that you made on the bitcoin that you sold for ethereum (in dollar value), as well as the profit on the ethereum sold for both bitcoin and neo.

The profit realized when you converted the gas into neo will also need to be calculated in dollar value.

What’s more, the passively mined gas will need to be reported as income (not capital gains) as mined coins are classified as such by the IRS.

Besides this one scenario, there are several other events that you will need to document the profit or loss on. These include:

- Other mining income

- Forks

- Splits

- Airdrops

- Wallet transactions

- Purchases where you used cryptocurrency

As you can see, this can get quite involved, especially if you are day trading, or making multiple trades a month.

Because of this, it is best to record each trade you make. Make sure to associate the profit or loss in dollars, as soon as you make the trade.

Trying to work these amounts out in hindsight can be extremely time-consuming.

However, it is possible, and if you have not kept a detailed book of your profits in dollars, this is what you will have to do to satisfy the IRS.

Let’s take a look at how to do this.

How to Gather Data to Calculate Your Cryptocurrency Gains and Losses

Before you can start calculating your historical cryptocurrency gains and losses, you will need to get hold of all the data pertaining to your trades and transactions.

Exchange Data

The place to acquire this information is from the exchanges that you have used. Online exchanges should be able to supply you with transaction reports that detail all buys and sells that you have made on the particular platform.

When tracking down this data, you need to think carefully about which exchanges you have used in the past. If you forget about one, your transaction data will be incomplete.

This will skew the final amount you enter on your tax return.

For those who have engaged in frequent trades over a long period, it might be hard to remember each platform you have used, but you must, otherwise, you will still violate the IRS requirements.

It is also important that you gain the data from not only the tax period you are dealing with but for all previous years as well.

If you have not calculated the profits and losses on your trades for the previous years, you will need to do that now, to be able to establish a base cost for all crypto ‘sales’ you made in the current year.

If you are a Coinbase user, you might want to take a look at our guide on Coinbase tax reporting.

Records of Cryptocurrency Received as Income

If you received any cryptocurrency as income in the form or a paycheck or payments for services rendered, you would need to accumulate evidence of this.

Other Records of Coins Received

You will also need to find records of any coins you received from airdrops, splits, mining, and forks.

Take note that you are not taxed via capital gains tax on the coins you received. Instead, they fall as income and are subject to income tax.

Capital gains tax comes into effect on any proceeds that you make when you sell these coins.

Calculating Your Cryptocurrency Gains, Losses, and Income

If you earn cryptocurrency from mining, this is viewed as income by the IRS and needs to be filed as such.

You need to record the dollar value of the rewards at the time of their happening. You can then use this amount as the base cost for calculating the capital gain or loss that happens when you sell the coins.

Note that miners are required to pay self-employment tax on their mining income.

Calculating Gains/Losses on Paychecks and Crypto Expenditure

If you are receiving your paycheck in bitcoins or another virtual currency, then you also need to know about the two types of taxation that apply to this.

Firstly, your employer is required to deduct income tax from your gross salary/wage and pay this over the IRS on your behalf in the form of withholding tax.

Therefore, once you receive your payment, you will already have ‘paid’ your income tax. However, there is further taxation that can come into play when you sell your crypto earnings for dollars or buy something with them.

If the crypto has increased in value, then you will make a profit at the time you exchange it for dollars. If you instead buy something with it, you will also have made a profit.

For example, the day you receive your pay bitcoin is valued at $7,000. The next day you buy a coffee with some of the bitcoin.

By this time, bitcoin has pumped and is now valued at $7,700. In this case, you will need to calculate the gain you enjoyed on the $3 coffee you bought.

Calculating Gains/Losses and Income on Mining

If you earn cryptocurrency from mining, this is viewed as income by the IRS and needs to be filed as such.

You need to record the dollar value of the rewards at the time of their happening. You can then use this amount as the base cost for calculating the capital gain or loss that happens when you sell the coins.

Note that miners are required to pay self-employment tax on their mining income.

How to File Your Cryptocurrency Gains/Losses

Once you have established what your total capital gains and losses were for the year on your cryptocurrency holdings, it is time to file.

If you have already filed your tax return when you get the IRS letter, then you will need to use IRS Form 1040X to amend it.

In addition to this you will also need:

- Form 8949: here you can list all cryptocurrency disposals you have made

- Schedule D: here you must list an aggregate sum of your capital gains for all assets you have sold, including virtual assets and cryptocurrencies *note cryptocurrency income such as payments, forks, mining, and airdrops must go under “other income” on line 21 of Schedule D

- Schedule C :here you can list any profit or loss from mining and self-employment related income and expenses

Once you have completed these forms in full, you can then file the amended return.

Get Assistance Filing Crypto Taxes

Accurately calculating and filing your cryptocurrency gains and losses can become complicated, especially if you have not kept a detailed record of them.

This is especially true if you have done a lot of cryptocurrency transactions over the last few years.

If you received a letter from the IRS and are feeling unsure about the process, consult a team of tax specialists. This will ensure that the amounts you declare to the IRS are entirely accurate and correct.

We specialize in assisting with cryptocurrency taxes and are also experienced in handling cryptocurrency-related audits. To reduce stress, worry, and possibly penalties and interest, contact us today to learn more about how we can assist you.