This year has brought unprecedented global changes, but it also resulted in efforts to provide relief for those negatively impacted by the COVID-19 pandemic’s economic impacts. Many businesses are taking advantage of payroll tax deferrals, for example, but there are a few factors to be aware of before you commit.

The biggest hang-up: Companies that participate in the voluntary payroll tax deferral plan will only see temporary relief. What does that mean? Here’s a glimpse at everything you need to know as a modern day employer.

The 411 On the Payroll Tax Deferral Plan

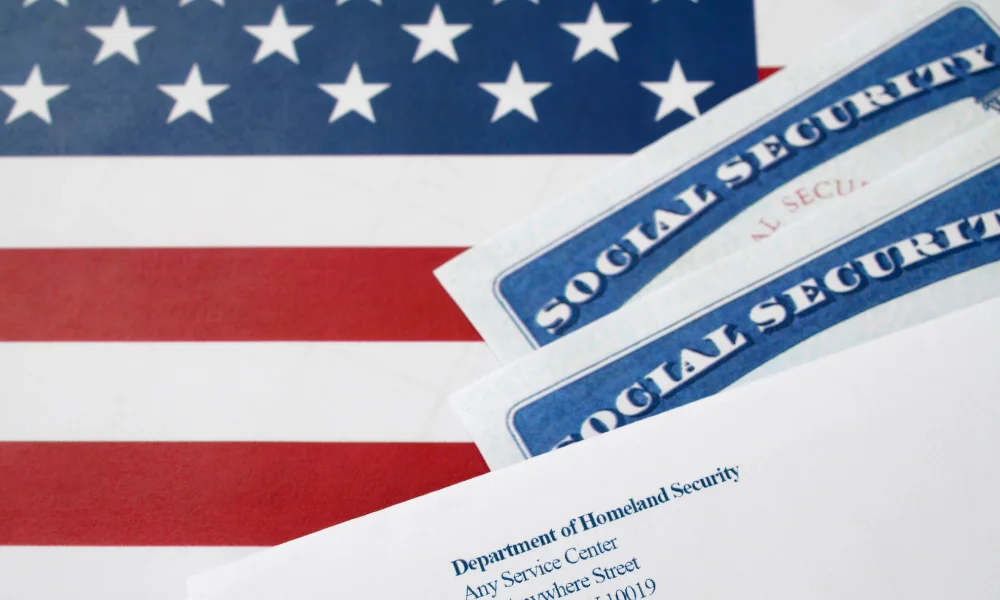

The President of the United States announced the Deferring Payroll Tax Obligations in Light of 2the Ongoing COVID-19 Disaster executive order on August 8, 2020. It directed the Secretary of the U.S. Treasury to allow specific tax payments to be deferred between September 1 and the end of the year.

- This executive order is different from previous legislation because it focuses on the employee’s portion of Social Security tax (6.2 percent).

- It states that it will put money back into American workers’ pockets by deferring payroll taxes.

- The goal is to stimulate the economy by freeing up extra cash during the last quarter of 2020.

- It does come with a major hang-up, however, mainly that the relief has a bit of a shelf life.

The short answer is that deferred taxes must be repaid in 2021, which could have huge implications and impacts on your workers’ financial situations next year. Employees will see bigger paychecks now, but they’ll shrink for a few months later as a result.

Which Companies Are Participating in the Payroll Tax Deferral Plan?

The tax deferral program is voluntary for employers except federal government offices, but lawmakers are pushing to give federal employees the choice to participate. There are several factors to keep in mind:

- Notably, the few companies that have so far said they’ll join the program are associated with the federal government.

- Many large employers have refused to share whether they opted into the plan.

- Many such larger businesses have opted out, including UPS, FedEx, Costco Wholesale, Albertsons, Johnson & Johnson, and General Motors.

- The U.S. Chamber of Commerce issued a coalition letter in August 2020 that was supported by 30-plus member associations — from the American Footwear and Apparel Association to the National Association of Realtors — and outlined key problems with the executive order.

=

We don’t yet know what the participation rate will look like when all is said and done, but many businesses are right to be unsure. Stated challenges so far include:

- Most of the companies that opted out said they were afraid of the large tax bill their employees would eventually have to pay.

- Others cited the difficulty in implementing the deferral because it would cause them to make changes to their payroll processing systems.

- Another challenge was the small window of time between the President’s announcement and the deferral plan’s start date.

This didn’t give businesses much time to understand the repercussions or their legal and ethical obligations to their employees.

Must-Know Payroll Tax Deferral Plan Conditions

So, what does your business need to know about the payroll tax deferral? First, the most appealing part of the program is that it gives employees more money right now. The deferral:

- Only covers a portion of their tax withholdings

- Covers the employee portion of Social Security tax – 6.2% from each paycheck.

- Applies to employees earning less than the threshold amount on each paycheck — $4,000 biweekly or $104,000 before taxes.

- Covers wages earned between September 1, 2020, and December 31, 2020.

Another challenge businesses face in implementing the program is that withholdings can vary, meaning eligibility for deferral may fluctuate from paycheck to paycheck. For example, commissions, bonuses, or overtime pay can boost an employee’s wages over the pay period’s qualifying rate. These variances make it harder for businesses to understand just how much the deferral will impact them and their workers.

It’s a Deferral, Not a Forgiveness

Remember, deferred taxes are not eliminated or forgiven. Many employers have been reluctant to participate in the program and have expressed concern about making their employees responsible for repaying the deferred taxes in early 2021. It will be the employer’s responsibility to:

- Collect and pay the deferred tax between January 1 and April 30, 2021, in even amounts

- Withhold the deferred amount in addition to normal tax withholdings until the debt is repaid

While the executive order states the Secretary of the Treasury will explore options to eliminate deferred tax obligations, only Congress can levy or forgive taxes. This means the program may have been created with promises that the current administration can’t keep, leaving businesses wondering about the right way forward.

Remaining Payroll Tax Deferral Plan Questions

The payroll tax deferral plan was announced and implemented quickly, and there are many unanswered questions for businesses of all sizes. Some of the biggest include:

- That there are no provisions about collecting a participating employee’s tax debt if that person is no longer on the payroll when it’s time to collect.

- That the promise of tax forgiveness may have convinced many employers to sign on to the deferral plan, but there’s a slim chance of Congress passing legislation before the repayment term.

- That a permanent payroll tax cut is not currently on the horizon.

- That if a payroll tax cut were to go into effect on January 1, 2021, Social Security payments would run out by mid-2023.

The U.S. Treasury Department’s lack of guidance has been a challenge for businesses already struggling to operate during the pandemic. Many owners are also worried about the threat to the nation’s Social Security program, which is funded by payroll taxes.

Preparing for the 2021 Tax Season

The Internal Revenue Service (IRS), businesses, employers, and employees will all be facing a tough tax season in 2021 amid all the new COVID-19 relief measures. There were already significant 2021 tax changes planned from the IRS, too, including:

- Waived required minimum distributions (RMDs)

- Higher standard deductions

- Changes to the Earned Income Tax Credit (EITC)

- A higher Social Security payroll tax cap

- And more

Each of these changes will impact filing taxes. The past year has been challenging for many businesses, and the laws seem to be ever-changing amid pandemic-related economic setbacks. Payroll accounting will likely be more challenging if your business is participating in any aid programs, including the payroll tax deferral plan, but the process gets a lot easier if you’ve got a professional tax attorney on your side to help.

Get Help Tax Planning for 2021

Silver Tax Group’s team of experienced tax attorneys is ready to help if you’re unsure how to approach tax planning in these uncertain times. We’re here to assist with any issues you may be experiencing so you can focus more on keeping your business afloat.

Contact Silver Tax Group today to get started with a consultation.