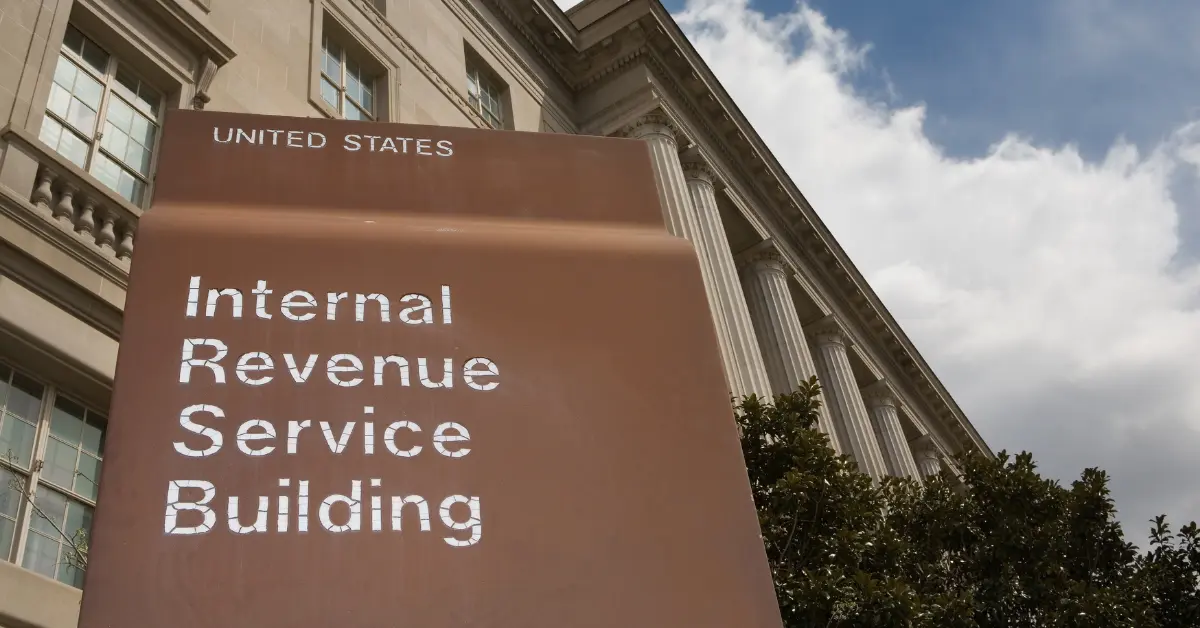

If you are among the growing number of business owners who have property and money housed outside the United States, then you likely know how important it is to protect your offshore assets.

But what is the best way to do this while making sure that you comply with IRS requirements? Below is a look at the role that FBAR Quiet Disclosure plays in IRS reporting and the penalties associated with the process.

What Is an FBAR?

An FBAR is an informational report that must be filed with the U.S. Treasury whenever a taxpayer has a financial interest in or signature authority over any financial account(s) located in a foreign country with an aggregate value greater than $10,000 USD at any time during the calendar year.

The form must be filed electronically through the BSA E-Filing System website no later than June 30th of each year for accounts held in the previous calendar year. Failure to properly file an FBAR can result in civil penalties up to $10,000 per violation plus other potential fines and penalties as determined by law enforcement agencies such as the IRS and FBI.

What Exactly Is FBAR Quiet Disclosure?

Before diving into the reasons why the IRS does not embrace quiet disclosure, it is helpful to know exactly what the term means. FBAR is an acronym for “Foreign Bank Account Report”, which pertains to IRS FinCen Form 114. Any U.S. individual who has control or ownership of a foreign account valued over \$10,000 is required to file an FBAR.

Simply put, FBAR quiet disclosure occurs when a taxpayer who is required to file an FBAR fails to comply with IRS standards.

In other words, the term “FBAR quiet disclosure” refers to a process where taxpayers who have not properly reported foreign accounts and assets, or who have failed to file a Report of Foreign Bank and Financial Accounts (FBAR) with the U.S. Treasury Department, can come into compliance without fear of prosecution from the IRS.

Generally, this is done by filing amended returns and delinquent FBARs for multiple years. It is important to note that this should not be done without the advice of a competent tax attorney, as mistakes made in the process could lead to stiff penalties or even criminal charges.

Upon realizing that they could be subject to penalties, the taxpayer knowingly files back taxes without going through one of their streamlined offshore amnesty programs. Quiet disclosures may also involve the proper filing of the current year’s taxes, but knowingly intentionally failing to correct returns from prior years.

When Should You Consider Quiet Disclosure?

If you have failed to file your FBARs or have not properly reported foreign assets on your tax returns, quiet disclosure may be appropriate depending on your specific situation.

In general, it is recommended that you seek professional help from a qualified tax attorney before proceeding with quiet disclosure.

This will ensure that all steps are taken correctly and that all necessary forms are filed accurately and on time.

Additionally, it is important to take into consideration any international tax treaties which may apply when making these filings as they could provide additional protection from penalties or criminal charges due to noncompliance with U.S. laws regarding international banking activities .

How Does Quiet Disclosure Work?

FBAR Quiet disclosure involves filing amended federal income tax returns (Form 1040X) for past years along with delinquent FBARs for those same years using FinCEN Form 114a (formerly Form TD F 90-22-1).

It is important to note that these amended returns need to include accurate totals for all taxable income from foreign sources including financial accounts even if they were not initially reported; they also need to include detailed information about each account so as not to draw attention from law enforcement agencies such as the IRS and FBI.

Additionally, any taxes due must also be paid at this time along with applicable late payment fees/penalties depending on individual circumstances; these payments can generally be made online via direct debit or check/money order sent directly to the IRS or other relevant government agency handling taxes owed.

Why Does the IRS Discourage Quiet Disclosure?

There are a number of reasons why the IRS frowns upon FBAR quiet disclosure. At the heart of the IRS’s disdain for quiet disclosure is its tendency to undermine the various programs the IRS has in place for taxpayers with offshore accounts. Here are three specific reasons why the IRS discourages quiet disclosure:

Reason One: Quiet Disclosure Undermines IRS Voluntary Disclosure Practices

The IRS strongly urges taxpayers with offshore accounts to voluntarily disclose their offshore assets or to participate in the various legitimate IRS-based programs for which they may be eligible.

This includes the Offshore Voluntary Disclosure Program. The practice of quiet disclosure completely defeats the purpose of these programs, serving as a tempting alternative for business owners who are willing to gamble with the IRS.

Reason Two: Some Taxpayers Use Quiet Disclosure as a Safety Net

By offering voluntary disclosure procedures in the offshore voluntary disclosure program, the IRS seeks to encourage taxpayers to comply with their requirements.

With quiet disclosures available as an option, taxpayers are not discouraged or deterred from stopping their practices. They merely begin to use quiet disclosures as a safety net if it appears that they may face consequences.

Reason Three: The United States Government Loses Revenue

When taxpayers resort to FBAR quiet disclosures, our government loses tax dollars that would have been paid if the taxpayer participated in the voluntary disclosure practices.

Additionally, taxpayers are treated inconsistently with respect to their behavior and taxpaying responsibilities.

What Are the Penalties Associated With IRS Non-Compliance?

"Offshore evasion remains a primary focal point of overall IRS enforcement efforts. Our Criminal Investigation and civil enforcement teams work closely with the Justice Department in the international arena to ensure our nation’s tax laws are followed. Taxpayers considering hiding funds or assets offshore should think twice; the civil penalties and criminal sanctions can be severe."

- Chuck Rettig, IRS Commissioner

The IRS website clearly states, “Failure to report offshore funds remains a crime,” and even lists it on their “IRS Dirty Dozen” list of scams. Accordingly, the penalties for unreported foreign financial accounts after failing to participate in one of the voluntary disclosure programs offered by the IRS are nothing short of harsh.

The IRS states in writing that violators are at risk for harsh penalties, stating that such “illegal scams” can lead to “significant penalties as well as interest and possible criminal prosecution.”

While the nature of the issued penalties will depend on the organization and extent of the violations, the IRS will often take 50 percent of the value of the account and the violator may be subject to criminal charges.

What Should Businesses Know Before Filing an FBAR Quiet Disclosure?

"The IRS will not impose a penalty for the failure to file the delinquent FBARs if you properly reported on your U.S. tax returns, and paid all tax on, the income from the foreign financial accounts reported on the delinquent FBARs, and you have not previously been contacted regarding an income tax examination or a request for delinquent returns for the years for which the delinquent FBARs are submitted."

- Internal Revenue Service Tweet

Before considering quiet disclosure as a path to take, there are three steps businesses should take. First, they should review IRS requirements on an annual basis to remain abreast of the latest changes to requirements.

Second, they should consider taking part in one of the IRS’s streamlined offshore voluntary disclosure programs. And third, they should seek the guidance of a trained legal advisor.

In addition to following these steps, businesses should have a plan in place to ensure that stakeholders and any employee with signature privileges receives regular compliance training to ensure that all IRS requirements are understood and followed carefully.

Finally, the benefits of participating in the voluntary disclosure programs offered by the IRS should be emphasized. Ideally, this training should be provided by an experienced tax lawyer with a proven track record of success handling FBAR challenges and FBAR penalties.

What Is the Single Best Way to Ensure That Your Business Is Compliant With the IRS?

As recommended above by the IRS, the single best way to make sure you comply with IRS requirements is to seek the expertise of an IRS tax lawyer. This is especially the case if you are worried that you may have failed to report any offshore monies and want to avoid unreported foreign financial accounts.

With the guidance of an accomplished tax attorney, you can rest assured that your offshore assets are protected and that you comply with IRS requirements.

As America’s most trusted team of tax attorneys, Silver Tax Group has been helping businesses resolve FBAR issues for a decade. We understand how stressful it can be to be at increased risk for IRS penalties and are here to respond to our clients’ needs 24/7.

We invite you to contact us today to schedule a complimentary consultation with one of our skilled tax law specialists. We look forward to serving as your trusted legal advocate.