IRS Form 1099-R Explained + Full FAQ

File Form 1099-R If the following applies to you:

You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of $10 or more from any of the following:

- Pensions.

- Annuities.

- Charitable gift annuities.

- Survivor income benefit plans.

- Profit-sharing or retirement plans.

- Any individual retirement arrangements (IRAs).

- Life insurance contracts that provide payments for total and permanent disability.

If a person retires and receives regular distributions from their retirement accounts, they will get multiple 1099-R forms.

You might also get the form though if you’re not retired too. Why might you still get a form from a retirement account if you’re not retired? Some of the reasons to get the 1099-R form before retirement include:

- Early distribution from a traditional IRA

- Take a 401K and roll it over to an IRA

- Close a traditional IRA or Roth

- Receive a payout on a matured life insurance policy

You are also allowed to borrow money from yourself for your 401K for certain purposes. If you do this and don’t repay the money, you’d also get issued the 1099-R form.

As you invest your money more broadly into different accounts for investments and retirement, filing your taxes can get more complex too. You’ll get more IRS forms that identify parts of your financial world and need to know how they fit into filing your taxes.

There will be a time when the money you’ve invested needs to get taken out too. When you do this the IRS will also expect to see the IRS Form 1099-R.

The 1099-R form gets issued by the fund that gave you money from your investment. The form helps to identify the money you received and what, if any, should get taxed.

IRS Form 1099-R Explained

The IRS form 1099-R requires financial institutions to report distributions. If there’s a $10 or more distribution made, the issuer must provide the 1099-R form to who received the financial distribution.

Payments of reportable death benefits require the use of the 1099-R form for reporting.

For most people, this gets used to report the distribution as income and include it on lines 4b and 5b of their Form 1040.

This form’s considered an informational form which means it’s used by the IRS from the issuer to know what should get taxed. When you file your taxes, you’ll attach Copy B to your tax form.

Don’t Mess With The IRS – Get Help From an Experienced Tax Attorney

When Is the 1099-R Form Available?

The IRS requires those who pay out a distribution to send this form to anyone who got the distribution by January 31 of the year following the year the money got distributed. This follows the same time rules as the IRS expects of an employer to send W-2 forms.

Many investors also offer a copy of the 1099-R form available on their website.

What Should You Do If You’re Given a 1099-R Form?

The IRS will expect you to report the income on the 1099-R form to them. If you have more than one 1099-R form, you’ll need to total up the amounts listed in Box 1. Then you enter the totaled amount onto your 1040 form.

The most challenging part of this form is knowing what income you’ll need to pay taxes on. This is often when you want to consider consulting with a tax professional.

The IRS provides instructions for Form 1099-R with the form and on the 1040 form too.

Click Here For the 2022 1099-R Form PDF

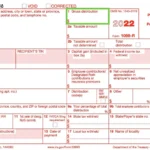

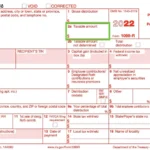

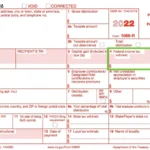

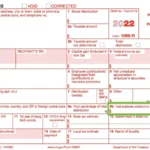

What Information Will You Find on the 1099-R Form?

There’s a lot of important information on the 1099-R. Let’s go over some of the boxes that are important and often raise tax-related questions for filers.

1099-R Box 1: Gross Distribution

This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

1099-R Box 2: Gross Distribution

This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the amount to include. As the payer, you’ll report this on line 4b or 5b on the 1040 Form.

1099-R Box 4: Federal Income Tax Withheld

This box is significant because it identifies the amount the payer withheld from the distribution reported. This matters because it identifies the amount of money already paid on the distributed amount.

1099-R Box 7: Distribution Code(s)

This box identifies the distribution code and tells the IRS the type of distribution taken by the taxpayer. The type of distribution matters because it helps to identify whether the money from the distribution is taxable or non-taxable. If the distribution was taken as a loan or roller, for example, the distribution code will help the IRS to know this. More on distribution codes shortly.

1099-R Box 9b: Total Employee Contributions

This box identifies the investment for a 403b or a life annuity in a qualified plan. This shows the amount you have already paid in taxes put into the plan. This matters because amounts already taxed by the IRS can be received back to the payee tax-free. Part of your distribution received will contain a return of basis. This amount is necessary to know so you can accurately identify the taxable amount of distribution as reported on the 1099-R.

1099-R Form Information for Filing

The 1099-R form has 2 sections. The left side of the section contains payer and payee personal information.

- The payer’s tax identification number, name, and address

- The Payee’s tax identification number, name, address, and account number if applicable

- The gross distribution

- Taxable and nontaxable amounts

- Employee contributions

- The type of retirement account

This information is important because it connects the payer and payee and their identifying information for the IRS when you file your taxes.

The 1099-R Form

There are several boxes on the 1099-R form, each with a specific purpose, like a regular W-2 form. This information is found on the right side of the 1099-R form.

- Box 1- Gross distribution

- Box 2a- Taxable amounts, look here to know what you’ll pay taxes on

- Box 2b- Taxable amount not determined and total distribution

- Box 3- Capital gain

- Box 4- Federal income tax withheld

- Box 5- Employee contributions/Designated Roth contributions or insurance premiums

- Box 6- Net unrealized appreciation in employer’s securities

- Box 7- Distribution code – Here’s where you see how your distribution is categorized

- Box 8- Other

- Box 9a- Percentage of the total distribution

- Box 9b- Total employee contributions

- Box 10- Amount allowable to IRR within five years

- Box 11- 1st year of designated Roth contributions

- Box 12- FATCA filing requirement

- Box 13- Date of payment

- Box 14- State tax withheld

- Box 15- State/Payer’s state number

- Box 16- State distribution

- Box 17- Amount of local tax withheld

- Box 18- Name of locality (if applicable)

- Box 19- Amount of local distribution

It’s important to understand what you’re looking at when you see the 1099-R form. This information gets filled out by whoever is sending the 1099-R form for you.

1099-R Distribution Codes

Included as part of the 1099-R form is a space for the distribution code. This code helps to identify what type of distribution is being reported on the form. The distribution codes are as follows:

- Code 1: Early distribution, no known exception

- Code 2: Early distribution, an exception applies

- Code 3: Disability

- Code 4: Death

- Code 7: Normal distribution

- Code 8: Corrective refunds taxable in the current year

- Code G: Direct Rollover to a qualified plan, 403(b), governmental 457(b), or IRA

- Code L: Loan treated as a distribution

- Code M: Qualified Plan loan offset

One thing to note about Code 4 is that it’s relevant. Retirement account distributions on Form 1099-R are taxable from the 2A Box. You would need to include the federal withholding amount in Box 4’s additional withholding amount.

Get Help Filing Your Complicated Taxes

If you take money from multiple accounts over the course of a year, your Form 1099-R can be complicated to understand. You need to understand the 1099-R filing process the IRS expects you to follow.

They want to be sure you will pay taxes on all the funds that need to be taxed. When your taxes are simple, it might be easy to file your own taxes or even use an online filer. But as you add more forms, like the 1099-R form, the taxes become more complex.

This is when you may want to consider getting tax consulting help. Seek the assistance of an expert tax attorney to help guide you through those complicated tax scenarios.

1099-R FAQ

Let’s take some to address common questions many taxpayers have related to this form. Of course, it makes sense to always consult with a tax professional to get the most up-to-date tax code information.

What Happens If I Didn’t Get a 1099-R Form?

There are a few reasons why you might not have received this form.

First, if you didn’t take any distributions that would count as income from your accounts, one wouldn’t need to be issued.

Second, some investments offer an online portal where they will put this information. If you agreed to receive the information electronically, it might be in the online portal.

Could I Get the 1099-R Form Even If No Money Was Withdrawn During the Previous Tax Year?

This might seem confusing, but yes, you could still get the form. You might get it because you had:

- Reported as a normal distribution, a fee redemption may have occurred on a non-qualified contract

- A collateral assignment may have been completed

- An ownership change

- A Roth conversion

I Rolled Over My Funds to a Different Carrier. Why Was I Sent a 1099-R Form?

This might happen if you roll over funds from one type of account to another, like a 401K to an IRA. The original carrier is required to report the rolled-over amount as income and it’s coded with the Distribution Code G on the 1099-R form.

What should happen is that the new carrier should also generate a form. They use Tax Form 5498. This tells the IRS they have received those funds reported in the 1099-R and the amounts should offset each other in your taxes.

Why Might I Get More Than Two 1099-R Forms?

There are several reasons you might get more than one form.

If you reside in multiple states when a carrier issues checks, you could get more than one.

You might also get more than one if a 72(t)/72(q) program was canceled or started up. This would happen if there is more than one distribution code needed.

What Is Significant About the Age 59½?

If you’re enrolled in a scheduled distribution plan and you turn 59½ in the middle of the year, you’ll get more than one 1099-R form. The reason for this is because you’ll need different distribution codes based on your age, before 59½ and after.

Before 59½, you’ll get a 1099-R that has a Code 1 that tells the IRS that this is an early distribution with no known exceptions. After 59½, the distribution code changes to 7, indicating a normal distribution.

If you reside in multiple states when a carrier issues checks, you could get more than one.

You might also get more than one if a 72(t)/72(q) program was canceled or started up. This would happen if there is more than one distribution code needed.

Understanding IRS Form 1099-R

The IRS Form 1099-R will be expected by the IRS when you get money from your retirement or investment fund. Depending on the situation of how the money is distributed will be identified in the distribution code on the form. This helps the IRS and you know if it’s taxable or you’ve already paid taxes on it.

Understanding these IRS forms can be confusing and overwhelming. Nobody wants to not report them correctly or not at all and end up in trouble with the IRS. If you’re feeling like your taxes have gotten more complicated and you need some advice, we can help. Contact us today to discuss your taxes with one of our specialized tax attorneys.

Free Consultation 24/7

Chad Silver

Attorney

Silver Tax Group Locations

777 South Flagler Drive

Suite 800 – West Tower

West Palm Beach FL 33401

4005 Guadalupe St

Suite C

Austin, TX 78751